- Male agency marketers are earning 31% more than female agency marketers.

- 96% of agency marketers put time aside for learning and development, although 39% do not have personal training budgets.

- 92% of local agency marketers feel secure in their roles.

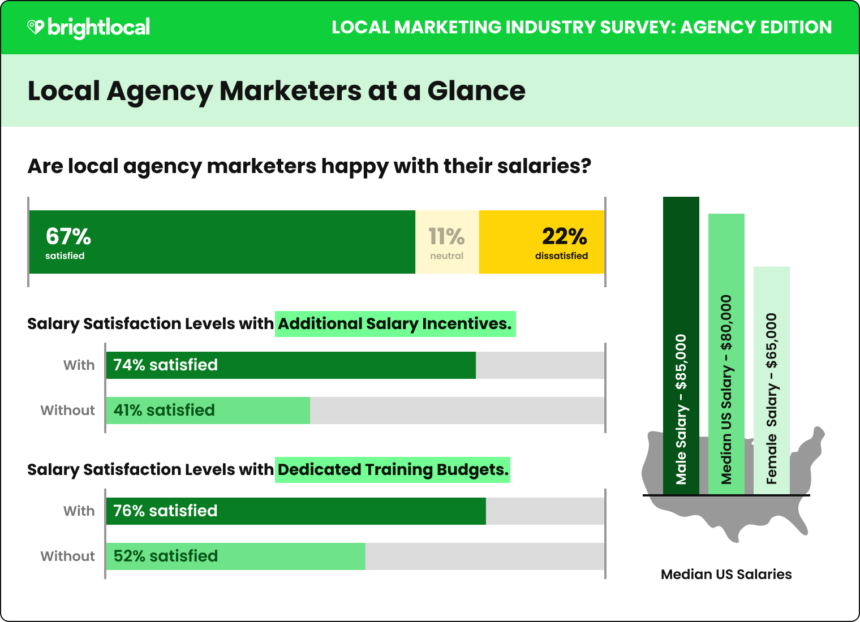

- 67% of local agency marketers are satisfied with their salaries.

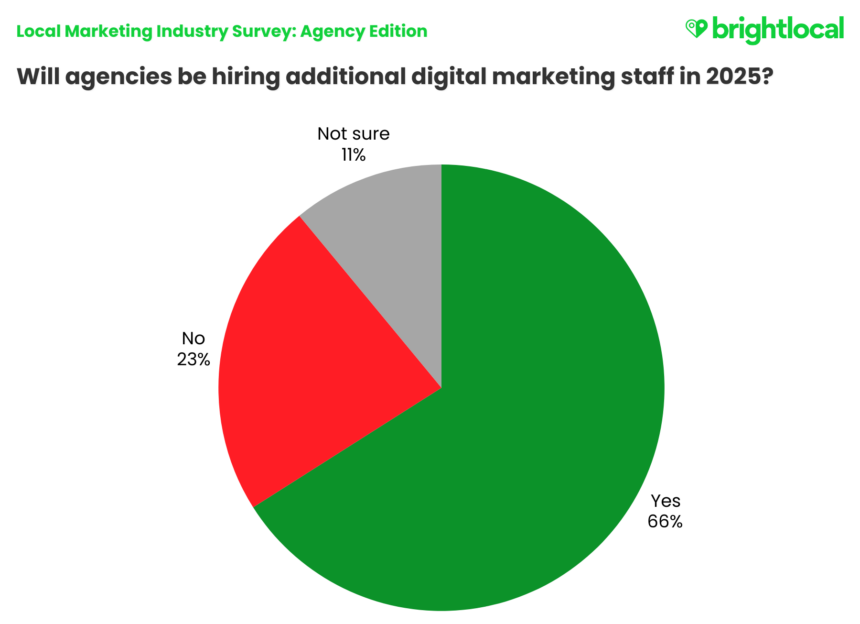

- 66% of agencies will be looking to hire in 2025.

- 22% of agency marketers do not feel they have clear progression paths at work.

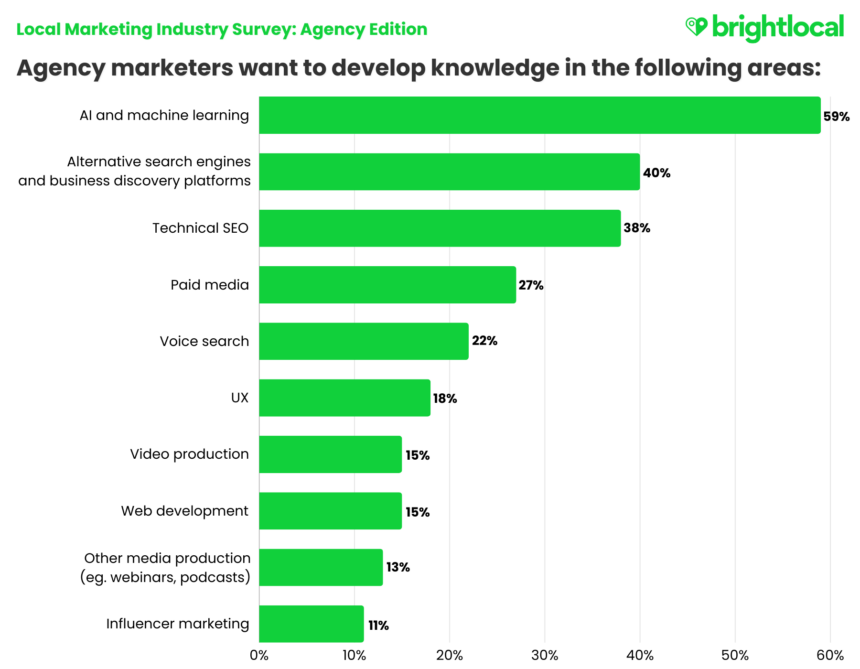

- Top three areas agency marketers want to develop knowledge in: AI and machine learning (59%), alternative search engines (40%), and technical SEO (38%).

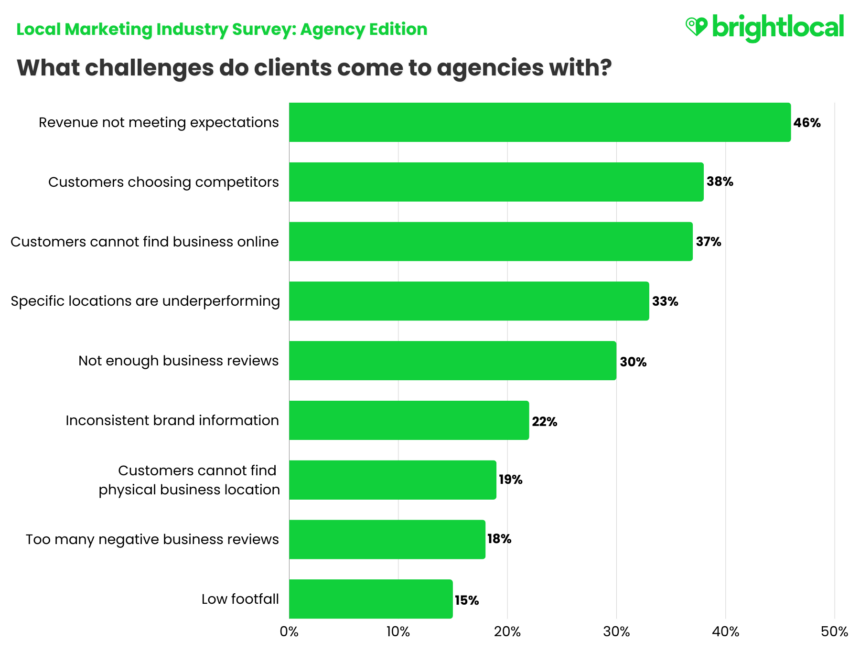

- Most common client challenges: revenue not meeting expectations (46%), customers choosing competitors (38%), customers cannot find the business online (37%).

As we approach the end of another raucous year in search and local marketing, it’s a good time to lift your head up and get a sense of where you’re at. As a consultant or agency owner, that might involve reflecting on your business goals for the year and thinking about what you want to achieve in 2025. For agency employees, it might be taking a breather to think about how you’re feeling in your current role.

We’ve been surveying the local search industry since 2011 to help marketers and SEOs assess its state. When you work in such a fast-moving and competitive industry, it’s natural to ask classic imposter syndrome questions, like “Am I doing this right?” or “What does everyone else think of this?”. So, we wanted to help marketers find the answers.

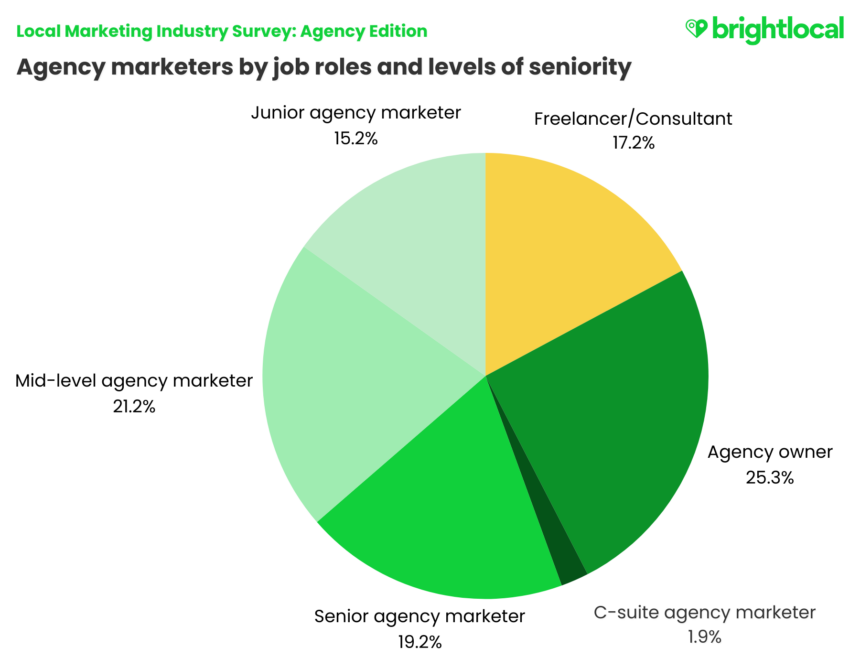

The Local Marketing Industry Survey: Agency Edition examines the experiences of almost 400 local agency marketers, including freelancers and consultants, agency owners, and agency employees of all levels. Let’s take a closer look at the insights.

Considerations

- Throughout this report, we’ll refer to freelancers, consultants, and agency employees together as ‘agency marketers’ unless otherwise explained. We set them apart where the nature of self-employment affects the relevance of those questions and topics.

- We have only used the responses of US respondents (62% of the survey population) for salary averages and median calculations.

- We collected gender information based on how respondents identified themselves.

Local Agency Marketers at a Glance

It helps to set the scene by taking a snapshot of how agency marketers are feeling about their roles and the wider industry. But who are we representing when we talk about ‘agency marketers’?

We aim to provide realistic and balanced representations of local marketers so that our insights can be relevant, useful, and, more importantly, actionable. Below is a breakdown of agency roles and seniority. Aside from the smallest segment for C-suite agency marketers, you’ll see a pretty balanced spread.

Salary Averages in the USA: Gender Pay Gap of 31%

The median salary for local agency marketers in the USA in 2024 was $80,000.

We present the median salary instead of the average because it’s a better representation of the ‘mid-point,’ whereas averages can be skewed by numbers in the extremes. When we extracted the same data from 2023’s Local Search Industry Survey, we found no change year over year. So, it doesn’t look like agency marketers are any better off in 2024 than they were in 2023.

However, when we break the salary medians down by gender, a different picture emerges. Male agency marketers are earning 31% more than female agency marketers, highlighting a significant disparity.

| USA median salary (Female) | USA median salary (Male) | |

|---|---|---|

| $65,000 | $85,000 |

According to Salary.com, the median US salary within the professional services industry is $77,454. Based on our findings, female local agency marketers earn 19% less than this, while males earn 3% above the professional services median.

Unfortunately, the gender pay gap disparity is not a new finding and is not just limited to this industry. Earlier this year, Search Engine Land found that male SEO professionals were earning 36% more than females, but it is an enduring issue across industries globally.

I hope that in providing these figures, female-identifying local SEOs and agency marketers can use these benchmarks as a resource to negotiate higher, fairer salaries. But obviously, it’s not as simple a fix as that. Nicole DeLeon provided some great research and conclusions for Moz in 2020, highlighting areas that need to be improved across the industry (and beyond), such as salary transparency.

Salary Satisfaction Levels

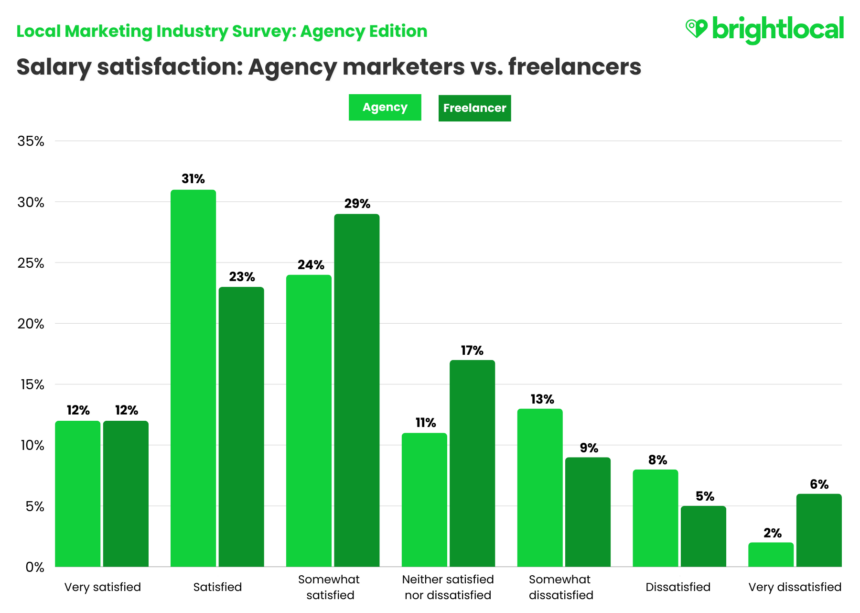

On the surface, the majority of agency marketers feel satisfied with their salaries—67% of all respondents said they were ‘somewhat satisfied,’ ‘satisfied,’ or ‘very satisfied.’

However, we decided to break out freelancers and consultants to provide a view from a self-employment lens and acknowledge that determining (and paying!) your own salary can be challenging. While the pattern largely follows a similar sentiment, it is noticeable that a higher percentage of freelancers and consultants are ‘somewhat satisfied’ compared to ‘satisfied’ (29% vs. 23%), and 6% of freelancers and consultants are ‘very dissatisfied’ compared to just 2% of other local agency marketers.

We also looked at salary satisfaction broken down by gender to see if, knowing what we do about the salary disparity, female agency professionals might be feeling less satisfied with their salaries compared to male agency professionals. Nothing stood out from this view, and the patterns for both groups reflected a similar, generally positive sentiment that looks much like the chart above.

| Male | Female | |

|---|---|---|

| Satisfied | 65% | 69% |

| Neither satisfied nor dissatisfied | 14% | 10% |

| Dissatisfied | 21% | 21% |

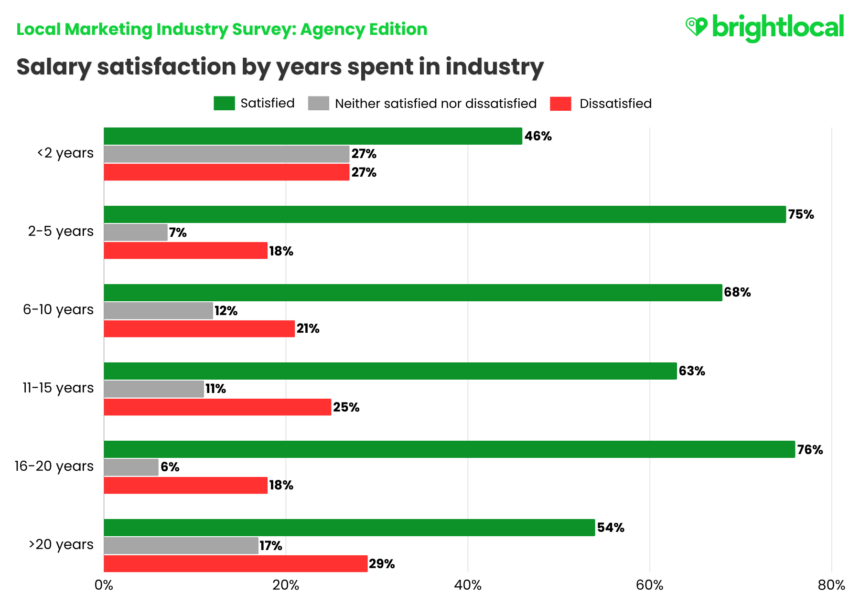

However, when salary satisfaction was broken down by years spent in the industry, one group stood out.

Just 46% of respondents with fewer than two years of industry experience feel satisfied with their salaries.

This could suggest that ‘entry-level’ agency professionals are eager to progress within their roles and earn higher salaries accordingly. It could also show that they feel frustrated at the compensation they’re receiving in relation to the responsibilities and tasks they have to perform.

Generally, entry-level agency SEO and local marketing roles can involve many necessary but often time-consuming (and sometimes menial) tasks rather than the juicier areas like strategizing. It also tends to be the stage of a career where you’re more likely to need to learn quickly on the job, so the pressure can outweigh salary satisfaction—meaning, it’s easy to see why this group of respondents stands out.

Incentives Beyond Salary

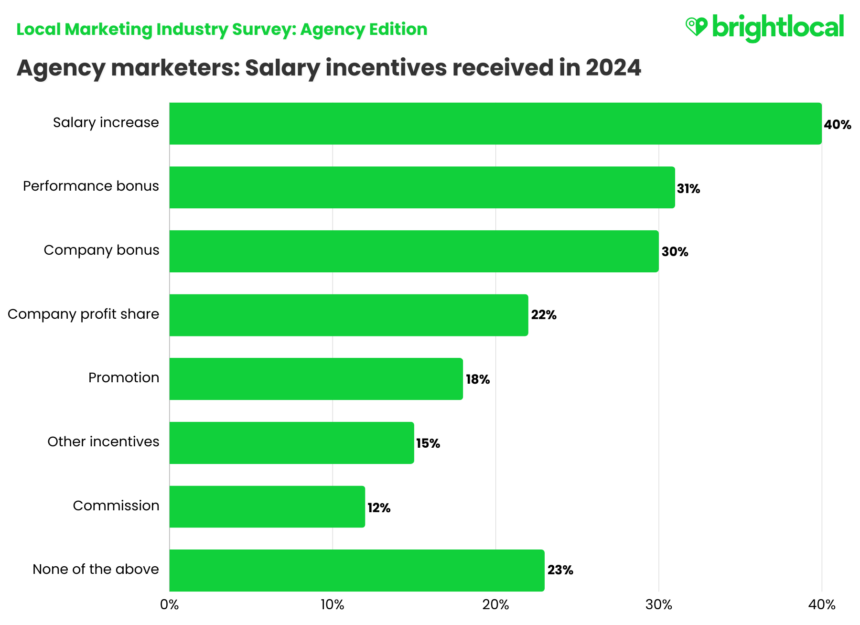

Of course, there are other financial incentives associated with (but not exclusive to) salaries that feed into the ‘package’ an employer provides that will affect salary satisfaction overall. Bonuses, profit shares, commission, and other reward types are attractive incentives that can essentially ‘top up’ salary levels, while the prospect of salary increases and promotions highlights opportunities for career path progression.

So, aside from measuring median salary levels, we also wanted to gauge the other ways in which agency marketers are being invested in by their agencies. It’s important to note that we excluded freelancers and consultants from the chart below.

It’s encouraging that 40% of agency marketers have received a raise in the last 12 months, while a further third have benefited from various bonus schemes.

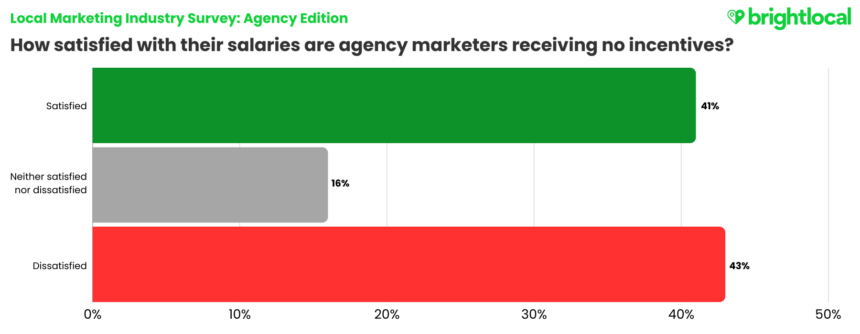

Almost a quarter (23%) of all agency marketers have not received any additional salary incentives, though. If we examine that group of local marketers more closely, we can see a distinct relationship to lower feelings of satisfaction around their salaries overall.

Incentives and motivation have been hotly debated topics in business and management disciplines for decades. As a business grad myself, I grimace any time a workshop facilitator asks the room if they know about the hierarchy of needs… but I digress.

While many will argue that financial incentives aren’t a true motivator in the workplace, the fact is that even though inflation has slowed down, prices for just about everything in life remain high.

So, for agency owners or even senior agency marketers, it’s worth considering how you can introduce incentives that recognize your team members more and reflect your commitment to investing in them.

Career Progression and Learning at Work

Clear career pathways and progression opportunities are a big ‘green flag’ for any agency wanting to hire and retain top talent. Yet it’s all too common to hear professionals say that the only progression opportunities for them at work are in line management.

Line management is a challenging task that requires a specific skill set. It is not for everyone. With this in mind, we asked agency marketers how they felt about their career progression opportunities at work.

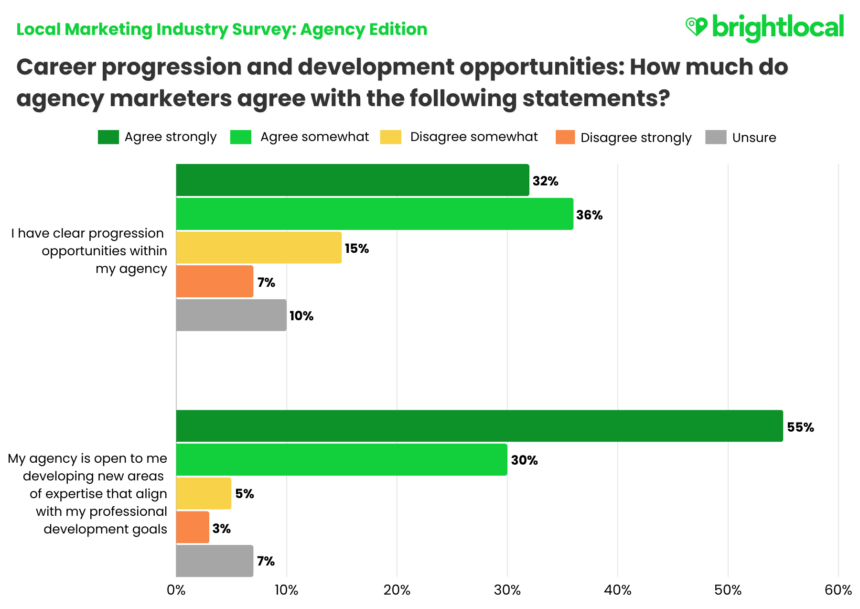

The two statements reflected in the chart highlight that the majority of agency marketers have opportunities to develop at work. However, there is an interesting difference between the certainty of having clear progression paths at work and developing new areas of expertise.

68% of marketers agree that they have clear progression paths within their agencies. In fact, a full 32% of respondents agreed strongly with the statement. Meanwhile, 85% said their agencies would be open to marketers developing new areas of expertise to achieve professional goals. Both are positive statements, but the difference suggests that development at work might be more self-led for some professionals, putting the onus on individuals to shape their development.

For some, that can be an empowering move, but realistically, it can be challenging to make time in your day-to-day life to learn new things. Having clarity in development and progression by ensuring line managers are regularly working with team members on a more formal plan removes that feeling that it’s ‘all on you’.

Training Budgets As An Incentive

Offering employees a personal training allowance, while not directly impacting salary, is a positive indicator that shows a commitment to growth and progression. In many cases, the ‘perk’ has become a desirable part of the overall employer package. It reflects good attitudes towards growth, and the personalization element highlights a sense of autonomy for agency marketers when shaping their development.

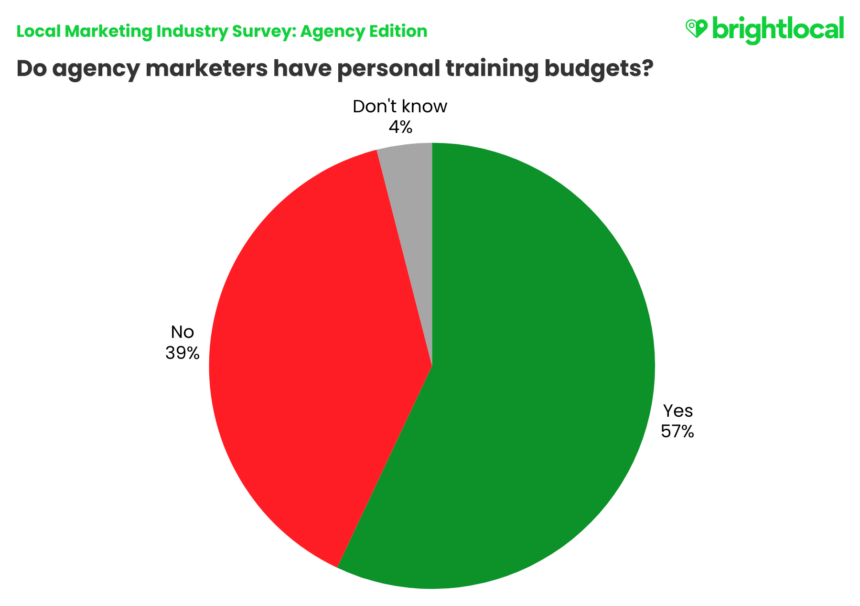

While freelancers and consultants can certainly allocate training and development budgets for themselves, we removed them from this dataset to examine how larger agencies approach training more closely.

Last year, we found that just 39% of agency marketers had access to personal training allowances, so it’s great to see how much this has improved, now standing at 57% of marketers.

For the remaining 43%, it might not necessarily mean that training and development isn’t an important part of their agency life. Access to events and industry conferences, product training or training with partners like Google and Meta are often regular parts of the job. Yet, arguably, those with access to a personal training budget are likely to benefit from both the necessary and chosen development opportunities.

What is your experience of personal training and development within your agency? Are you free to determine your own training, and if not, do you feel you still have good development opportunities? Feel free to share with us on LinkedIn or in The Local Pack, we’d love to hear your insights.

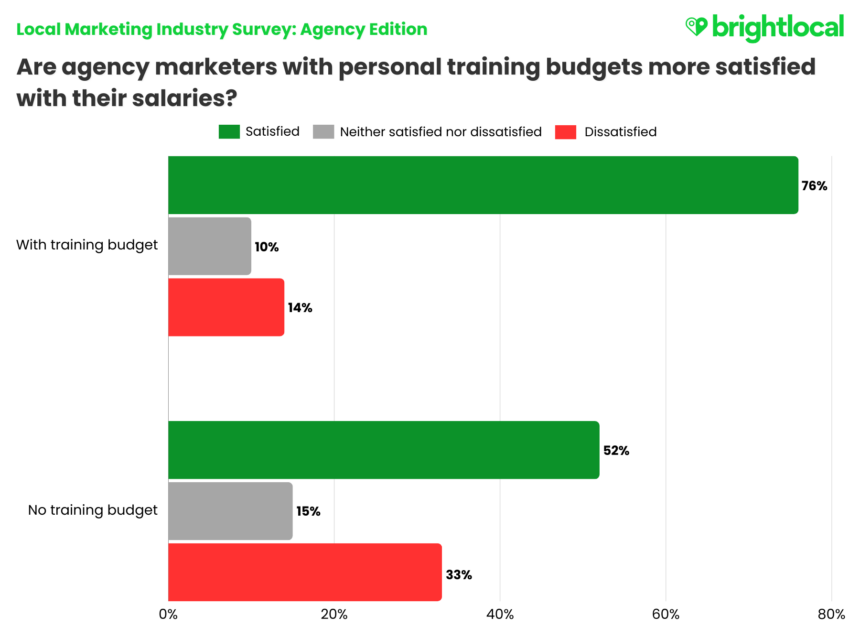

We also had to wonder, while a training budget isn’t a direct financial incentive, does this autonomy and empowerment mean agency marketers are more fulfilled with their salaries?

While we can’t directly compare all salaries here to say that those with training budgets are earning more than those without, it certainly seems like there is a relationship between salary satisfaction and personal training budgets. 76% of local agency marketers with training budgets are satisfied with their salaries, compared to 52% of agency marketers without allowances.

It follows that better access to training and development ensures professionals are learning new skills, therefore placing them in better positions for career progression, and leading to overall salary satisfaction.

Feelings of Job Security

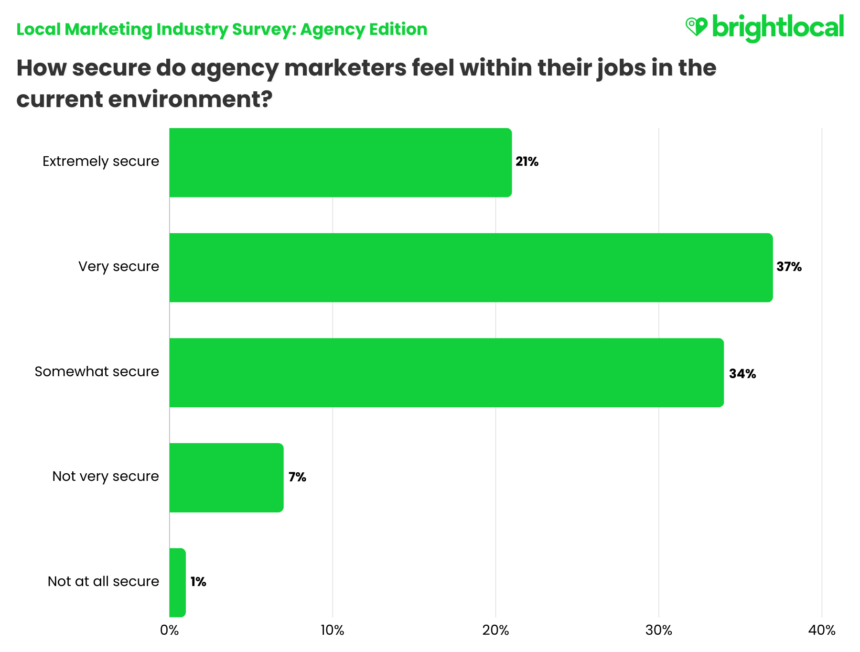

Finally, and arguably more importantly than salary satisfaction, how are local agency marketers feeling within their roles right now?

It seems like we’re never short of ‘big things’ to acknowledge when discussing the current business or economic landscape, from inflation and significant industry layoffs to political unrest and global conflict. Therefore, it is important to gauge how secure marketers feel at work, and hopefully, it can help answer one of those imposter syndrome questions we mentioned at the start of the report.

Overall, the picture is strong, with just 8% of marketers stating they don’t feel very or at all secure. However, looking at this small group of respondents more closely, almost half are business owners, whether consultants or agency owners, so it gives a glimpse into how those with the closest eye on the bottom line are feeling.

Breakdown of job security levels by job role:

| Freelancer/Consultant | 16% |

| Agency owner | 28% |

| C-Suite agency marketer | 3% |

| Senior agency marketer | 13% |

| Mid-level agency marketer | 28% |

| Junior agency marketer | 13% |

Moving Onto New Roles

All of the areas that we’ve discussed so far can become key reasons for wanting to move on to a new role. But there are other reasons for moving on that might sit entirely outside of an agency’s control, such as personal commitments and changes in circumstances, perhaps even a big career change. So, where do local agency marketers sit at the moment?

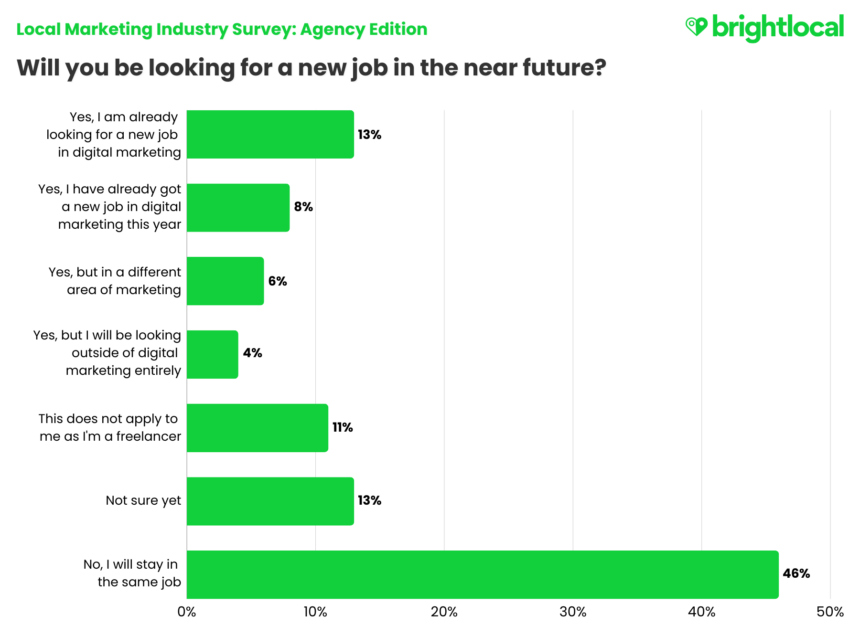

Given that we can probably assume those who aren’t sure right now aren’t looking for a new job any time soon, that means approximately 65% of agency marketers plan on staying put for now. For the remaining 35% of marketers, what’s prompting their decision to move?

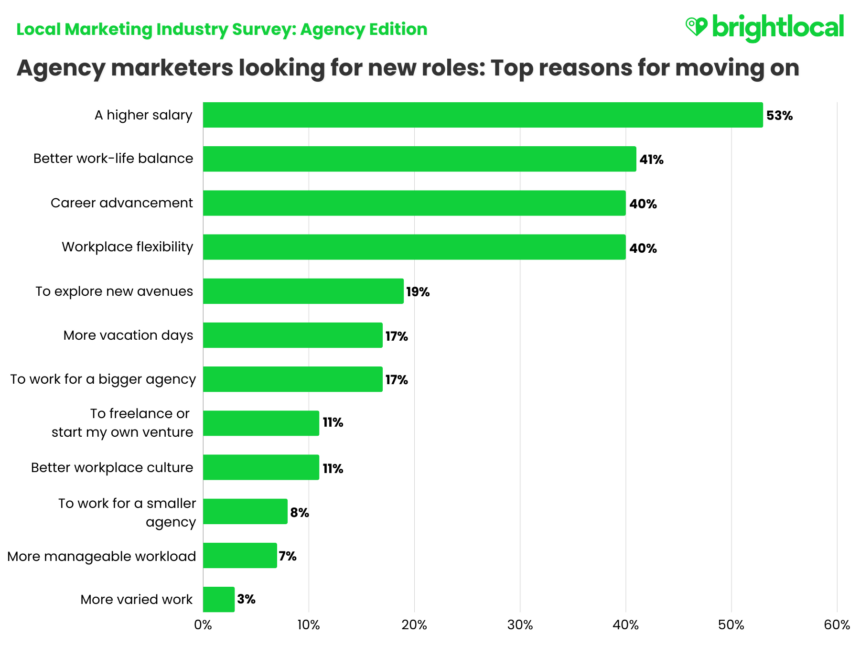

The main reason is pretty clear, and it comes back to our earlier point that, yes, money isn’t everything… but it is actually also sort of everything. 53% of marketers plan on moving on for a higher salary. Agency owners should wonder why that might be—are you paying your employees what they deserve, and are conversations around salaries approachable? For those professionals that did receive a raise in 2024, were they paid enough?

Meanwhile, improved work-life balance (41%) and workplace flexibility (40%) are two key areas that go hand-in-hand and show that many agency professionals are seeking a job that more closely matches their needs.

Work-life balance and flexible working have become standard components of discussions around the workplace. You cannot move on LinkedIn without coming across thought leaders discussing their views on hybrid working, workplace flexibility and work-life balance. Even though 2024 seems to have been a big year for ‘return to work’ mandates, it’s clear from our findings that work-life balance continues to take precedence for agency employees.

Agency Health, Life and Approaches to Structure

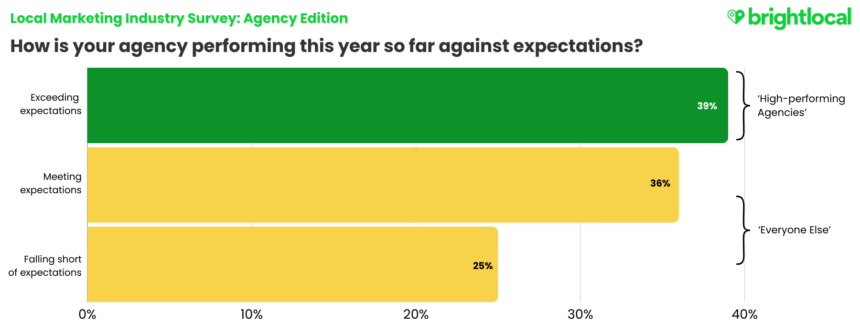

In the following sections of the report, we’ll examine some key areas of agency life through the lens of ‘high performance.’ To determine who the high-performers were, we asked marketers what their agency’s primary goal had been throughout 2024, and followed up by asking how they’d performed so far towards that primary goal.

For the sake of this section we have divided up respondents into ‘High-performing Agencies’, and ‘Everyone Else’.

- ‘High-performing Agencies’ = Respondents who said their agencies were ‘exceeding’ performance expectations.

- ‘Everyone Else’ = Respondents who said their agencies’ performance has either ‘met’ or ‘fallen short’ of expectations this year.

This view can help us understand what the ‘High-performing Agencies’ are doing differently from everyone else.

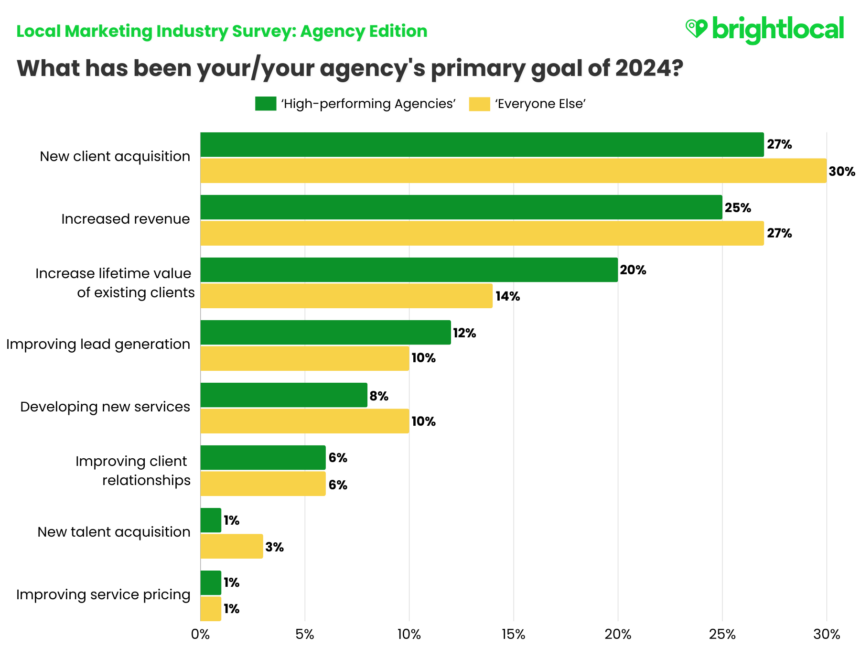

Looking at those business goals, we can see that all agencies are largely following the same trend; new client acquisition, increasing revenue, and increasing the lifetime value of existing clients were the top three priorities.

The key difference, though, is that ‘High-performing Agencies’ prioritize increasing lifetime value (AKA customer retention) more than ‘Everyone Else’ (20% vs. 14%).

While there’s not a huge difference between the two percentage points, it raises an interesting point that seems to come up repeatedly when discussing business goals: the importance of customer retention.

Earlier this year, we explored this theme in the Brand Beacon Report 2024, where similar findings highlighted how high-performing brands also valued customer retention more than their average-performing competitors. In that report, we touched on the supporting evidence that shows customer loyalty can have a greater impact on your bottom line than simply chasing new customers.

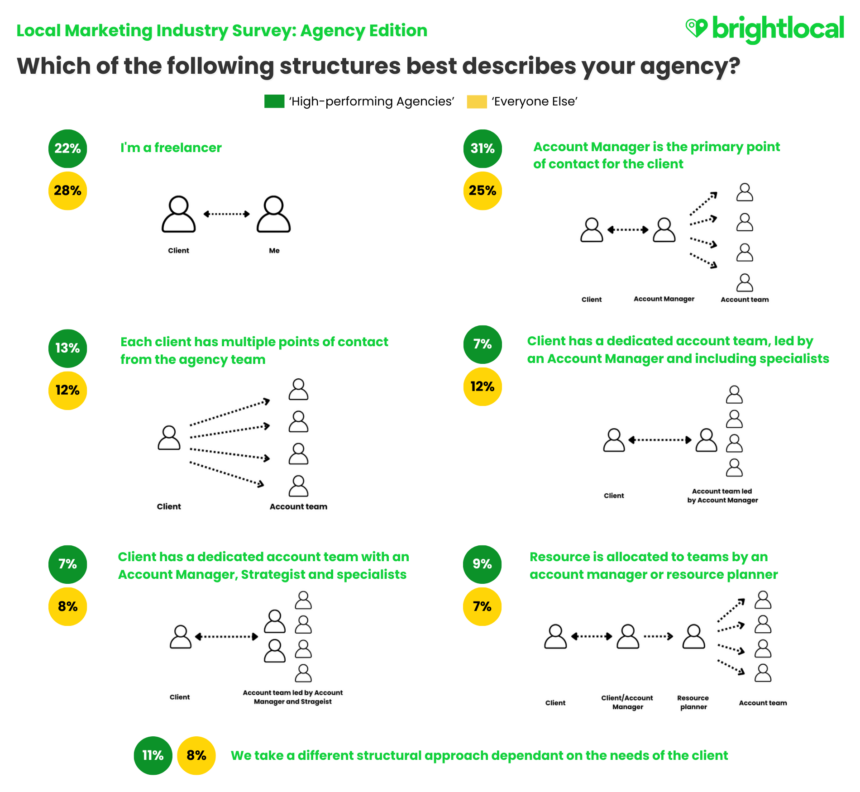

The ‘Right’ Agency Structure

The way an agency is structured and works with its clients is crucial to its success—but is there a right way of doing things? You know what I’m going to say here: well, it depends.

The overall size of an agency and its teams and the variety of services offered will influence how things are run, and it may change as the agency scales or diversifies. We were interested to see how agency marketers are typically set up and also whether we could glean any insights from those ‘High-performing Agencies’.

Overall, there is a fair mix of team structures, which you’d expect to see. Aside from our freelancers and consultants, the top agency team structure is one where the account manager is a primary point of contact for all client work. It is also by far the most common structure for ‘High-performing Agencies’.

At first glance, I was surprised at these results, mainly based on my own experiences working within smaller, more collaborative agency team structures. Perhaps there is something to be said for the efficiency of running on this model, leaving channel specialists to actually spend time executing the work.

Obviously, we’re not going to recommend restructuring your agency based on these insights, but if you ever find yourself wondering if there are better ways of doing things, it might give you some food for thought.

Approaches to Billing Clients

Billing is another area that completely varies based on the nature of the work you do, how your agency is structured or, as a freelancer, how you like to work. It’s also an area that has a lot of new agency owners or start-up consultants scratching their heads, so it’s useful to benchmark the approach. Again, is there a right way?

| 2024 | 2023 | |

|---|---|---|

| Monthly fee based on deliverables | 54% | 64% |

| Per project | 41% | 39% |

| Monthly fee based on hours | 29% | 22% |

| Hourly rate | 21% | 32% |

| Per lead | 9% | 2% |

| Day rate | 9% | 3% |

Monthly fees based on deliverables (or retainers) are still the most common billing method, although it’s very interesting to note the downward shift year-over-year (54% vs. 64%). Coinciding with this, there appears to be an upward trend in agencies billing by project (41% vs. 39%) and those calculating retainers based on hours (29% vs. 22%).

A monthly retainer based on hours suggests that these agencies have a very clear idea of how much their service products cost. On a similar note to the team structure section, it could also nod to a sense of efficiency in how agencies deliver their services. Alternatively, an hourly retainer model could be more attractive to some clients in that they can work with account managers to spend the money on the services they need accordingly.

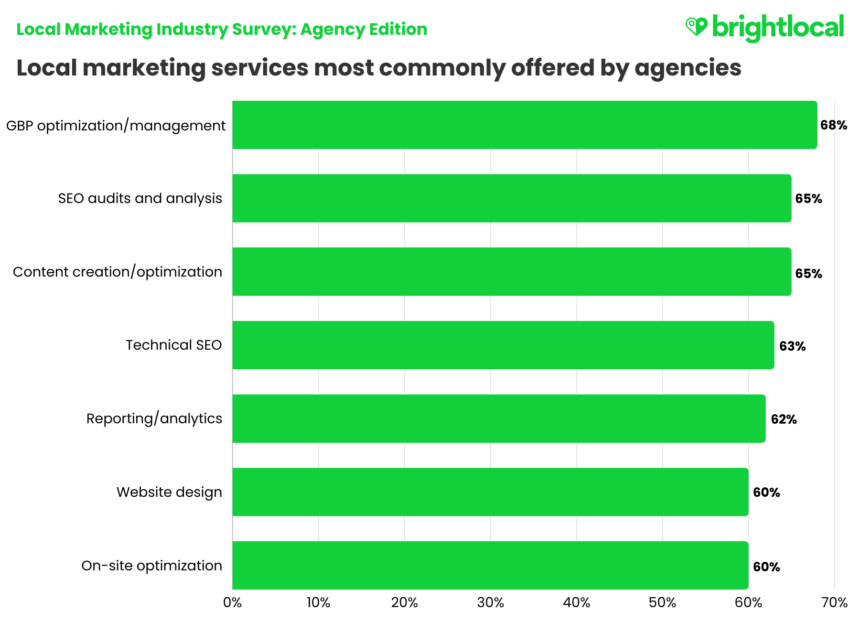

Local Marketing Services Provided

Which services are agencies packaging up into their core local marketing offering?

Before delving into a more comprehensive list, we’ve summarized the most commonly offered local marketing services in the chart below.

The majority of what we’d call the ‘fundamental’ local marketing services sit at the top of the list of services most commonly offered to clients. Although website design appears to be a surprisingly high (60%) offering for local marketing agencies, in this case, it is more common than local SEO pillars like citation management and review management.

The full list of local marketing services is shown below.

| Google Business Profile optimization/management | 68% |

| SEO audits and analysis | 65% |

| Content creation/optimization | 65% |

| Technical SEO | 63% |

| Reporting/analytics | 62% |

| Website design | 60% |

| On-site optimization | 60% |

| Citation building/cleanup | 53% |

| Social media | 53% |

| Competitor research | 51% |

| Schema markup | 50% |

| Online reviews management | 49% |

| PPC | 47% |

| Email marketing | 46% |

| Google Local Services Ads management | 46% |

| Content outreach/link building/digital PR | 40% |

| Google Business Profile spam fighting | 32% |

| Video marketing | 29% |

| Google penalty recovery | 22% |

| Influencer marketing | 16% |

Based on previous benchmarking surveys, we expected review management, PPC, and social media to appear higher in the list. However, both PPC and social media require very different skill sets, and it’s not uncommon for clients to use multiple agencies based on their specialities.

It is interesting to see that less than half of agencies offer review management (down by approximately 2% on 2023’s Local Search Industry Survey). Could it be that, rather than providing this service, agencies are encouraging and educating clients to implement these strategies themselves? This might also show that businesses and brands themselves have become more savvy about owning these areas of local marketing in-house.

The areas lower on the list, though, can also act as a gap analysis of sorts by highlighting that there is space in the local marketing agency market for ventures into these areas.

Of course, it’s important to consider that the services agencies offer are most often in response to what is in demand.

In fact, we asked marketers about the common challenges that clients present to them at the start of a relationship. You might find it useful to look at these when determining your own areas of focus for service products. Are you offering the right services to meet these needs?

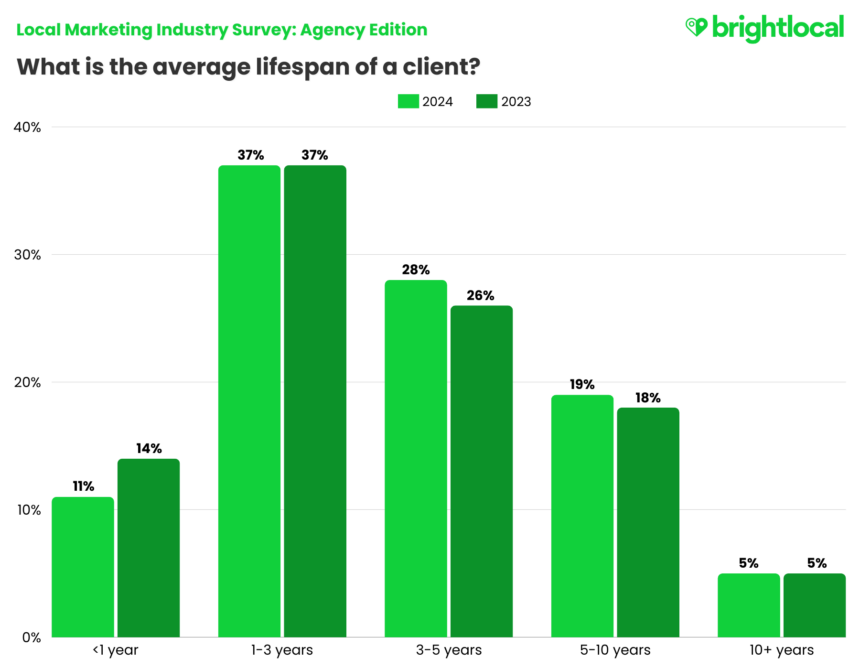

Client Lifespan and Turnover

The aim of a successful agency is not necessarily to have the most clients but to have clients with fruitful and mutually beneficial partnerships. Sometimes, these partnerships come to a natural end as a project wraps up, while others are based on longer-term strategies and vision.

It’s an amazing feat to be able to say you’ve worked with a client for five or ten years, but you want to make sure that the relationship is still fruitful for both of you.

At first glance, the pattern for ‘High-performing Agencies’ versus ‘Everyone Else’ is largely similar, and it looks like the sweet spot for everyone is a client partnership between one and five years.

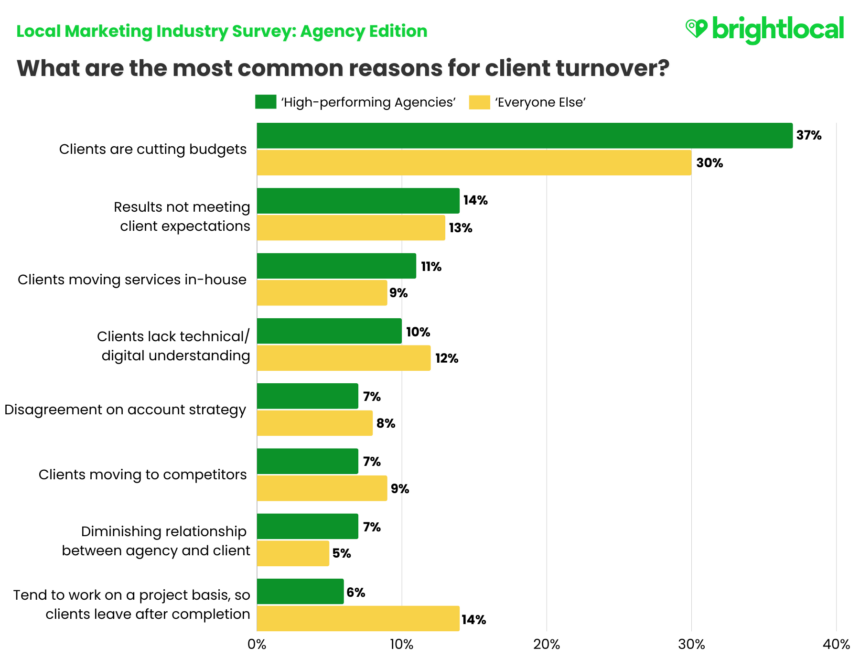

However, it’s also notable that ‘High-performing Agencies’ seem to retain the longest partnerships of 10 years and over more commonly. So, what are the top reasons for client turnover when they do inevitably move on?

It’s not surprising that budget cutting is the most common reason for client turnover. Whether you’re a high-performing agency or not, if clients are looking to save dollars, partner services and tools are often the first things to be scrutinized.

The reasons for turnover appear fairly even across all local agencies, but what is the least common reason for ‘High-performing Agencies’ is actually the second most common reason for ‘Everyone Else’: project work. Again, we’re not going to make any bold recommendations about overhauling the way your agency is doing things, but if your agency isn’t performing against expectations or is struggling with client turnover, it could be useful to examine the ways you are selling and billing work.

Reacting to Developments in Search

We can’t discuss the state of the search marketing industry without acknowledging some of the developments, innovations, and—let’s face it—shakeups influencing the way agency marketers do their jobs.

You don’t need me to point out how often things change within SEO. Along with constant developments and improvements to key local marketing products like Google Business Profile (GBP) that can change the tactics businesses in different industries use, the industry has seen plenty of big swings in 2024. I am, of course, referring to Google’s AI Overviews (formerly Search Generative Experience), ChatGPT Search, and other changes in the way people search for things and get information online.

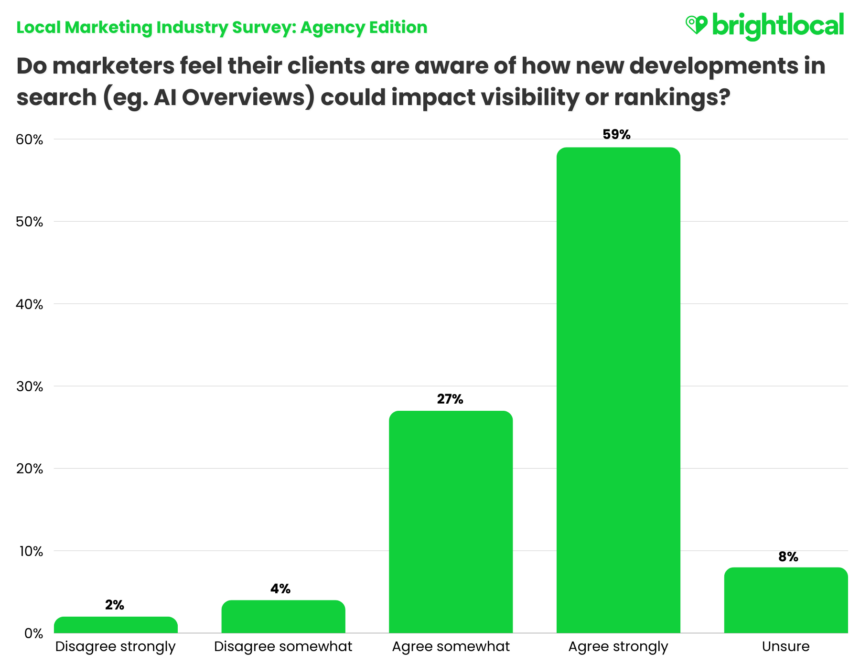

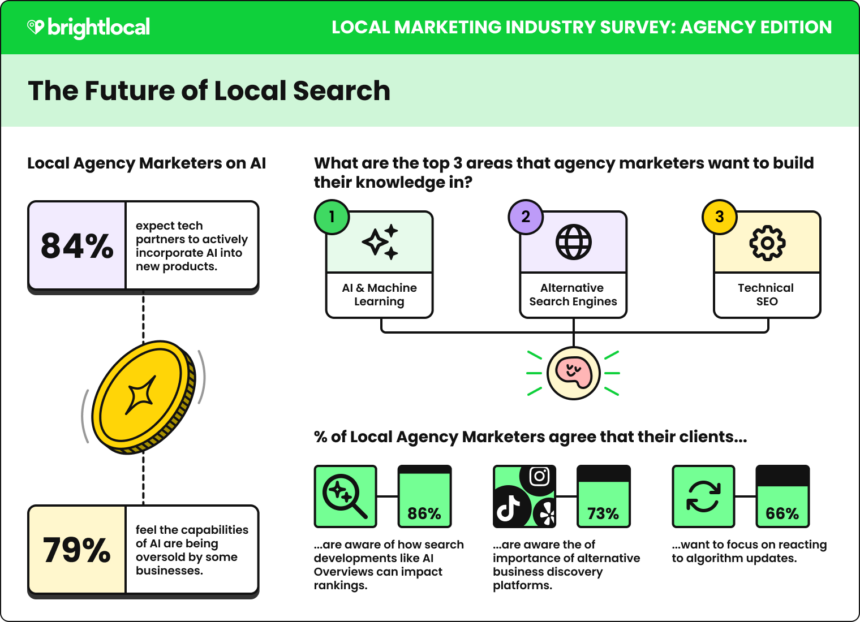

When big news breaks, agency marketers quickly turn to industry news outlets, experts and peers to see the reaction. But how aware are their clients of what’s going on?

86% of local marketers agreed that their clients are aware of how new developments in search could impact their business visibility and rankings.

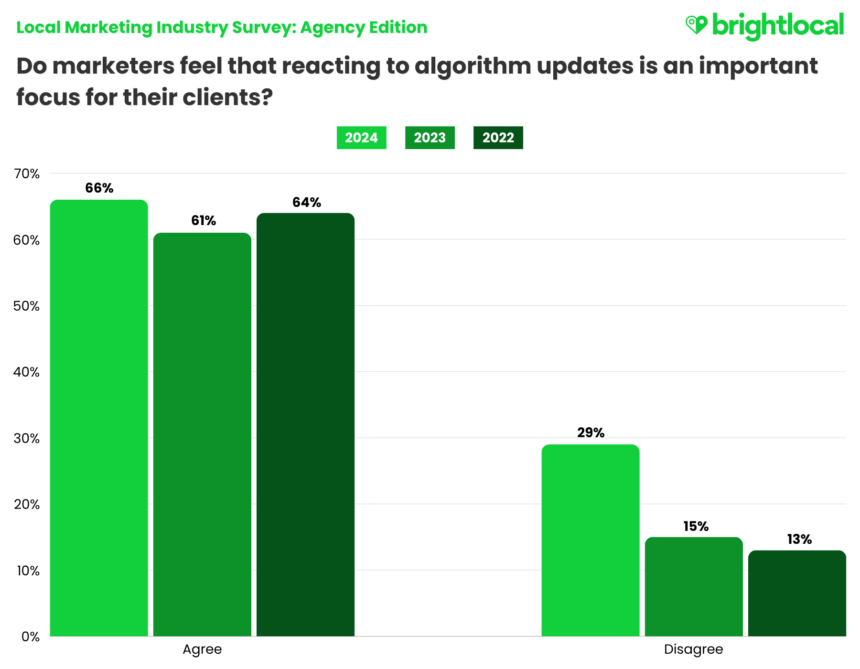

Over the years that we’ve been running industry surveys, we’ve asked local marketers whether their clients see reacting to algorithm changes as an important focus. Considering algorithm updates are usually something you don’t ‘see’, Google overhauling its SERPs with AI Overviews has been big news.

66% of agency marketers said their clients feel reacting to algorithm updates is an important focus in 2024, up 5% from 2023. It makes sense that clients want to stay on top of such changes.

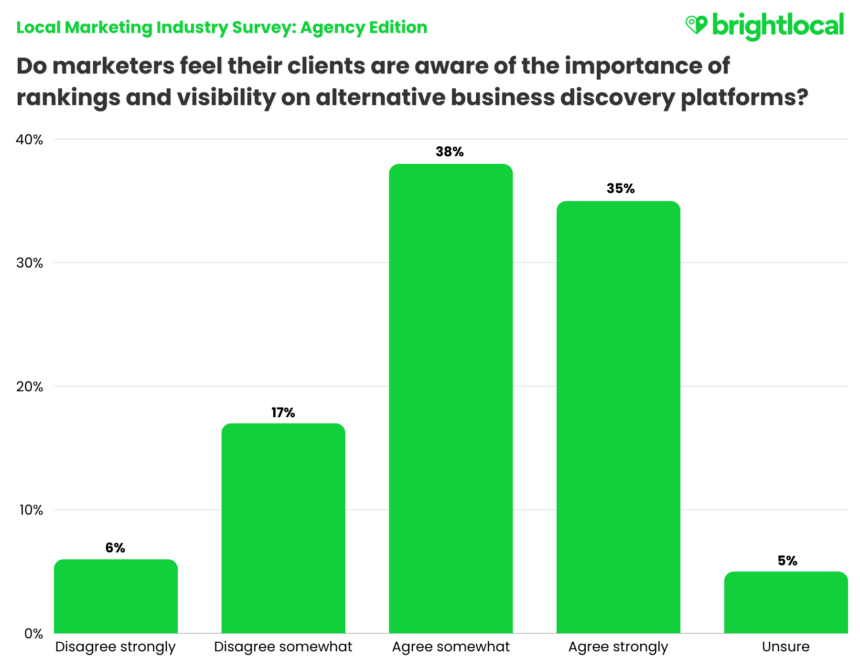

Yet, as we know, the nature of local search is changing in ways beyond traditional search and the ways in which people discover businesses are changing. What about developments beyond Google?

73% of local marketers agreed that clients are aware of the importance of ranking beyond Google. Although lower than the awareness of algorithm changes, it’s positive to see this in such high numbers. With the news of ChatGPT Search still hot off the press, it will be interesting to see how this might change in the coming months.

Local Marketing Agencies in 2025 and Beyond

With such big developments in the industry continuing to roll out, and absolutely no sign of the AI hype dying down, exciting opportunities lay ahead for agencies and their clients.

AI and Big Opportunities

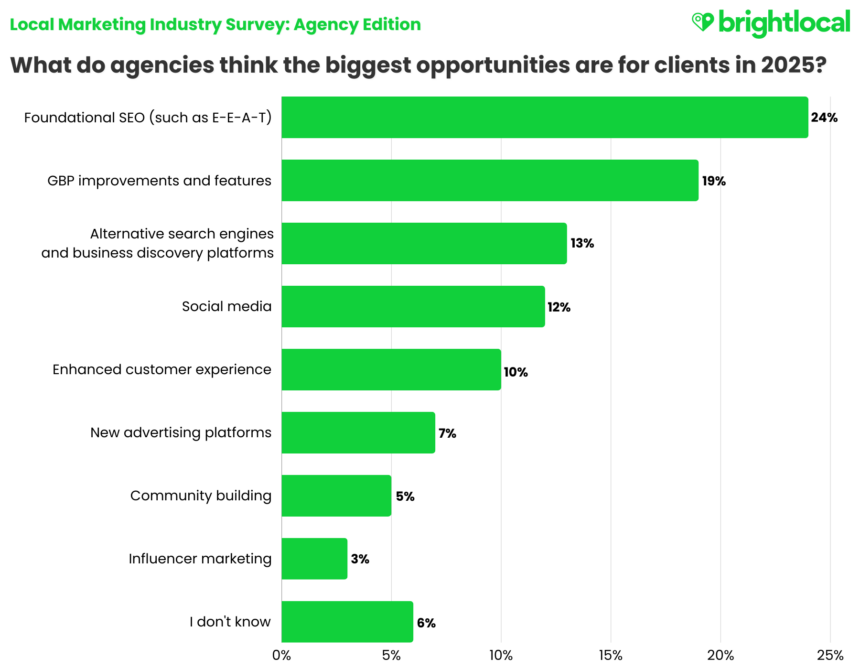

Alongside big tech swings in 2024, we’ve also seen a real return to basics in terms of the impact of foundational SEO. E-E-A-T continues to be at the top of experts’ minds when highlighting the importance of focusing on end users. At the same time, those specializing in certain verticals or niches are quick to highlight the benefits of new GBP features.

On the whole, where do agency marketers think the biggest opportunities are for their clients in 2025?

As a content purist, it fills me with joy to see that E-E-A-T is front of mind for agency marketers as the top opportunity (24%) when it comes to their local marketing strategies. Of course, being at the behest of Google’s guidelines, you could argue that it leaves little choice for those wanting their clients’ content and websites to be found. But, a strong focus on creating content and experiences that are truly helpful to the end user can only be a good thing.

I’d expected to see alternative search engines and new advertising platforms with higher percentages, particularly with how platforms like Reddit have gained such visibility in SERPs and become an attractive advertising option.

Perhaps it’s too soon to expect agency marketers to have strong thoughts about strategies beyond Google. Although ChatGPT Search is using Bing’s Index to power its search engine functionality, it’s still early days.

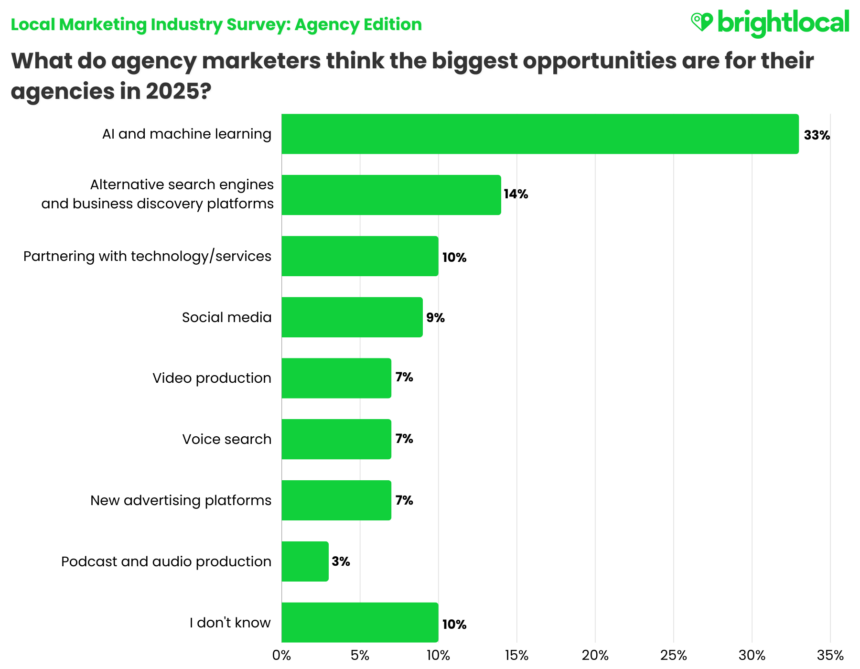

In the areas of local marketing that agency marketers believe to be the biggest opportunities in 2025, it’s no surprise that the most common answer is AI and machine learning.

As the biggest opportunity for their agencies, it makes sense that it’s also the most common area in which agencies want to improve their own knowledge.

59% of agency marketers want to develop their expertise in AI, and it’s a sensible answer too, no matter your thoughts or skepticism on AI. There is a lot out there, with baiting email subject lines and constant streams of new articles on the subject, and clients often expect agencies to be up to speed on the ‘latest’ thing. So, wanting to get to grips with AI beyond a general understanding is a good business decision.

Plus, despite the healthy sense of optimism around the opportunities AI can bring, agency marketers seem to be also conscious of how it’s being sold to them.

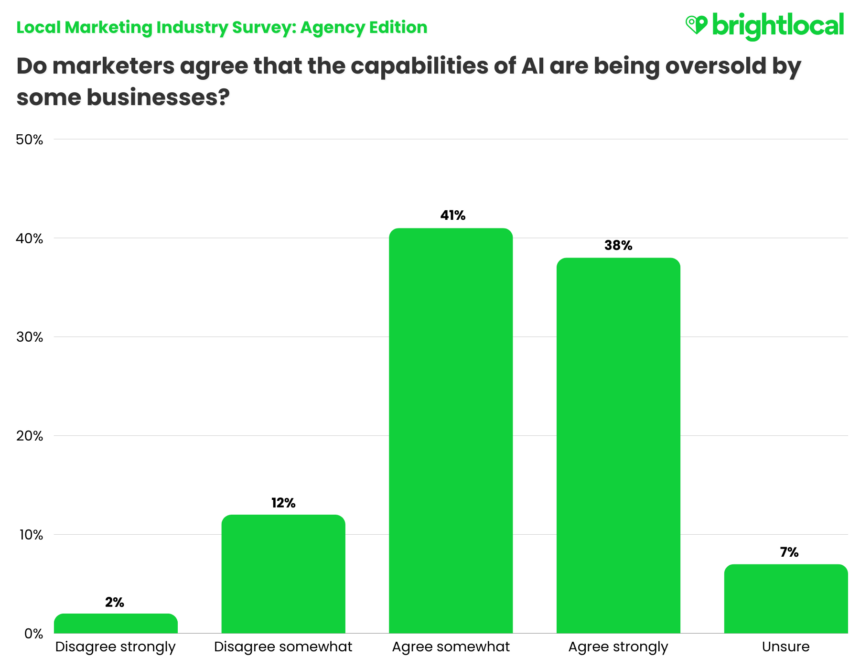

79% of agency marketers said that they feel some businesses are overselling the capabilities of AI. And, if you think about how often you see ‘do x with AI’ shoehorned into meta titles in Google results now, you can’t blame them.

As we pointed out in our generative AI case study last year, it is ever-evolving, and professionals should remain cautious of its capabilities for now, particularly as far as accuracy is concerned. We are increasingly seeing cases of ‘AI-washing‘ throughout various industries, in which businesses are being held accountable to inflating the capabilities of AI in relation to their own products.

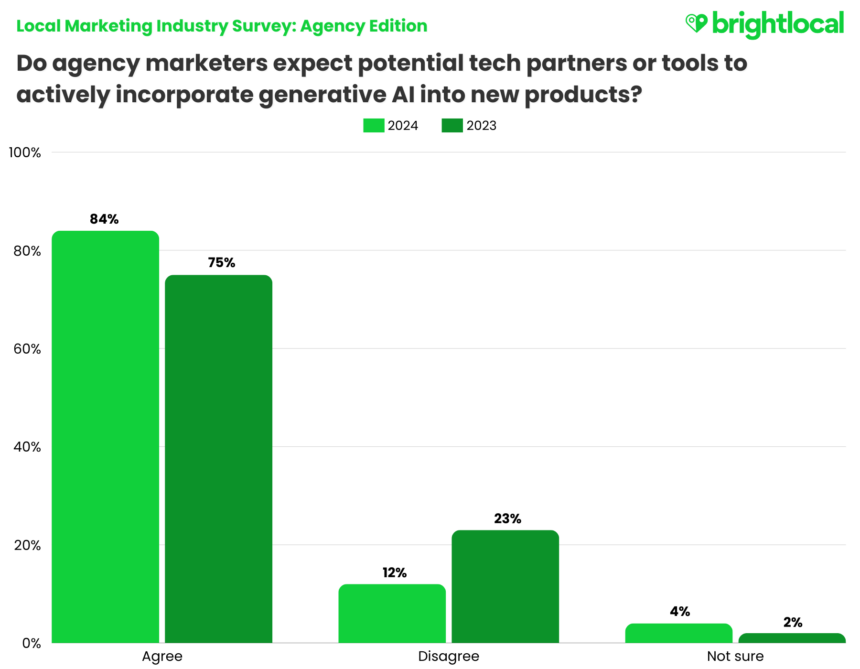

It’s particularly interesting, then, that despite a sense of caution and skepticism, agency marketers still expect potential tech partners to actively incorporate AI into new products. Following generative AI’s explosion into the industry in 2023, we started asking local marketers about their expectations of AI moving forward.

Not only do agency marketers still expect tech partners and tool providers to incorporate AI into their products, the sentiment appears even stronger in 2024.

So, wait a minute, what are we saying here? Let’s summarize:

- 33% of agency marketers think the biggest opportunities for their agencies lay within AI.

- 59% of agency marketers want to develop their own knowledge in AI.

- 79% of agency marketers think that some businesses are overselling the capabilities of AI.

- But, 84% of agency marketers still expect potential tech partners to actively incorporate AI into new products.

It’s a slightly confusing message overall, but in my mind it suggests that there is a sense of wanting to be seen to do the right thing or be known for keeping up with the latest tech developments.

Investing in the Future

Overall, the future of local marketing agencies paints a fairly strong picture. Along with an appetite to develop marketer expertise (and, therefore, agency services) in relation to AI, agencies appear optimistic about their growth, both in terms of increasing team sizes and maturing their existing tech stacks.

66% of agencies told us they’ll be hiring in 2025. Although we didn’t ask agencies about AI roles specifically within their agencies this time around, it will be interesting to see whether we see changes in team structures or service product offerings throughout 2025 that can be attributed to how AI is influencing the workplace.

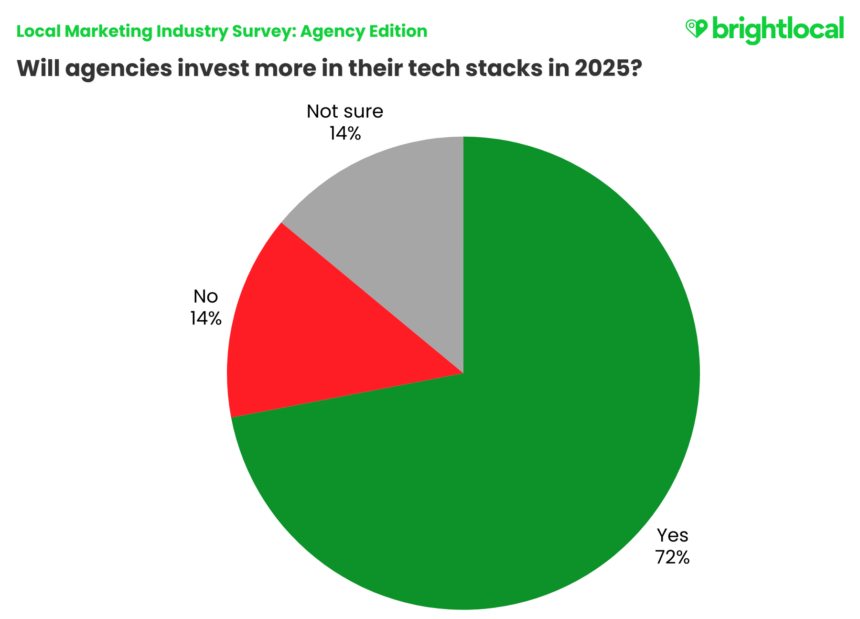

Meanwhile, almost three-quarters of local marketing agencies plan to invest more in their stack stacks next year. It’s important to remember that investing in technology doesn’t always mean adding ‘more’ to the stack and often involves maturing. Streamlining platforms for better visibility across teams, improving integrations, cutting loose outdated or redundant tools, and investing in new products to support the demand for new services are just a few obvious benefits of investing more in technology.

So, it’s encouraging to see that marketers are willing to make the investment rather than shy away from making potentially grand investments.

Thanks for reading!

Thanks for taking the time out to read the Local Marketing Industry Survey: Agency Edition. Once again, we owe a huge thanks to the local agency marketers who participated in the survey—we really can’t do it without you!

We hope you found these benchmarks useful. Anything you’d like to share or discuss from this report? Be sure to tag us in your posts on LinkedIn or start a post in The Local Pack, we always love to hear your commentary and feedback.

If you’d like the opportunity to contribute to research like this, make sure you’re signed up to receive the BrightLocal newsletter.

About the Local Marketing Industry Survey: Agency Edition

The Local Marketing Industry Survey was conducted via across August and September 2024 using BrightLocal’s subscriber channels, social media, and peers within the community.

The survey population is made up of 385 respondents, of which 53% identify as male, 44% identify as female, 1% identify as non-binary, and 2% prefer not to disclose gender.

Publishers are welcome to use the charts and data outlined within this report, crediting BrightLocal and linking to this article’s URL. If you have any questions about the report, please contact [email protected] or [email protected].