Last week we published the Local SEO Industry Survey 2014. With over 1,700 SEOs answering 19 different questions on subjects such as company size, clients and revenue, there was a sizeable amount of data to draw conclusions from.

The results were insightful, highlighting stats like the fact that 1 in 5 local SEOs had a turnover of less than $30k, and that the average monthly spend by SMBs on local search is $1,020.

Of course, however insightful the results can be from a survey like this, they often have a tendency to raise many more questions from the answers. We’ve also looked at comments that have come in, querying particular stats, or sparking debate on what some of the answers mean when looking at the bigger picture.

So we’ve taken the step to look deeper into the data we have, and examine responses against other questions. For example, it’s useful to know that 1 in 5 local SEOs are converting less than 10% of new leads – but which type of businesses are doing better at this? and how does that compare to their company size?

The further insights into the Local SEO Industry Survey 2014, have been looked at across 2 main areas:

- Type of SEOs – how the different sized operations in the industry answered different questions

- New business development – how active are businesses of varying size and success levels at targeting new clients

Update – Important Disclaimer:

Following the publication of the Local SEO Industry Survey 2014, it became apparent that there was some misunderstanding about the term “turnover” in relation to the original question 3: “What was your turnover in the last 12 months?“. Our intention for question 3 was to understand the relative success of a company by comparing its profit or revenue.

BrightLocal are a UK based company but the majority of our customers are based in North America. In North America, the term “turnover” can be used to measure a loss of clients over a period of time, whilst in the UK it is a term which relates to revenue. Following further investigation from a sample of responses on a follow-up survey, we can calculate that up to 50% of respondents considered turnover to be a measure of “client loss”, whilst the other 50% considered it to be a measure of revenue.

Therefore the results on charts related to revenue / turnover are somewhat skewed. In this piece we have now removed any further insights into that area for the time being.

Type of SEOs

1. Type of business vs Number of SEOs in the company

In the survey, 84% said that they have 5 or less SEOs in their company. We wanted to explore how this relates to the different types of businesses we had responses from.

Key Findings:

- National agencies have the most SEOs in their ranks

- Freelance SEOs generally work alone or as part of a 2 man operation

Analysis:

This chart helps to illustrate the different resources available for different sized operations. Larger agencies obviously have more ‘hands on deck’ to assist with local search.

However, does the average local SEO in a larger agency have more clients to personally look after than a freelance SEO?

2. Type of business vs Number of clients to personally look after

Key Findings:

- SEOs at larger agencies are individually responsible for more clients

- Freelancers handle the least clients – almost 50% less than at larger agencies

Analysis:

National Agencies may have more SEOs on their teams, but they are also individually responsible for a greater amount of clients. Freelancers, who seemingly work on their own or in a pair are in charge of significantly less clients individually.

Of course, this doesn’t necessarily mean that one party is worked harder than another – a freelancer as a self-employed individual may well be responsible for all areas of the business, and will more likely have to deal with everything from client acquisition, to monthly reporting, to invoicing & billing. Agencies with greater resources may be able to delegate much of this work to different teams of staff.

New Business & Sales

We’ve seen how different sizes of SEO businesses make varying amounts of revenue. But how does that relate to new sales?

Higher staff numbers must in turn bring added pressure to not only maximise the revenue from existing clients, but also crucially, to win new business.

3. New leads contacted vs Lead conversion rate

Key Findings:

- Avg. conversion ranges between 37%-45%

- No clear correlation between conversion rate & quantity of leads contacted

Analysis:

We can now see that the key to winning new business is not necessarily linked to the number of leads that are followed. It’s not a volume game, although I did expect to see conversion dropping off with more leads contacted as the attention & care taken on each call/pitch would be less.

The key to winning new business is surely down to the successful demonstration of expertise, and the ability to understand & meet a clients needs.

A demonstrable reputation is also a massive plus in an industry which has a problem with trust & reliability – a good reputation reduces the risk of a business owner saying ‘yes’ to you vs some other guy/girl.

It would however, be useful to see which types of businesses are better at delivering these attributes. In the next chart, we’ll first compare which companies are more active at contacting new leads, and then finally we’ll see which are the most effective at converting new business.

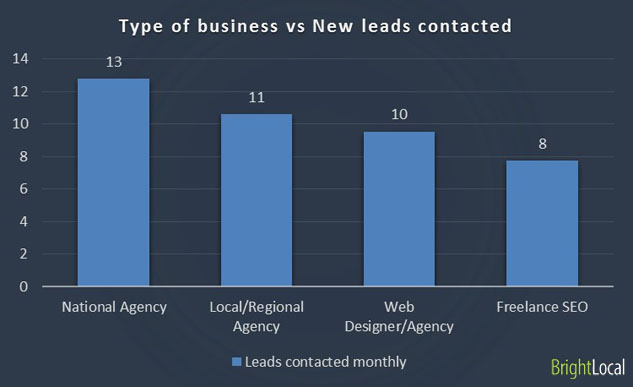

4. Type of business vs Number of new leads contacted (monthly)

This chart helps us understand which types of local search businesses are approaching the most new leads on a monthly basis (please note that ‘in-house SEOs’ have been removed).

Key Findings:

- National SEO Agencies contact the most new leads per month

- Freelance SEOs contact the least new leads per month

Analysis:

The chart is fairly self-explanatory and we can see there is a direct correlation between the size of an SEO business and the levels of new business development which they persue.

As discussed above, freelance SEOs may be responsible for the whole life-cycle of a client, and potentially have less time on their hands to undertake new business development. Whilst national agencies with more resources and larger teams, can afford to be more active at contacting new leads. Of course, as touched upon above, a national agency with greater numbers of staff may feel increased pressure to not only maintain growth but increase revenue on a continual basis, and so new business development is a bigger necessity.

It also highlights the issue of client turnover – not in a revenue sense – but in terms of how long a client will stay with a local search agency or consultant.

5. Type of business vs lead conversion rate (%)

Key Findings:

- Local / Regional agencies have the best lead conversion rate

- Freelance SEOs have the lowest lead conversion rate

Analysis:

National agencies are more active at contacting new leads but they are seemingly less successful at converting. Local / regional agencies have the highest success rate.

Of course, it could be argued that a national agency targets larger multi-location businesses or franchise clients and that these are harder to convert due to increased competition, but it does show help to illustrate once again, that quantity does not necessarily equal quality when it comes to reaching out to new clients.

6. Industries served vs lead conversion rate (%)

Key Findings:

- Those serving 2-3 industries have a slightly lower conversion rate with new clients

Analysis:

There’s not a great deal of wisdom to take from this chart. However, there is a slightly higher conversion rate for those SEOs that target clients within lots of different industries, or those that focus on one industry alone.

It could be argued that local SEOs which concentrate on one industry alone will have a better chance of demonstrating their expertise to potential clients. Similarly, those SEOs that target lots of different industries have the bonus of being able to demonstrate expertise in a wide number of areas.

It’s the SEOs that target 2-3 industries that seemingly have a slightly lower success rate, however small.