Consumer behavior will always be a hot topic. As marketers, strategists, or decision-makers, understanding why people behave the way they do is not just fascinating but crucial for brand success.

The online reviews business is hugely competitive. Reputation, as they say, is everything. Even on the research front, we increasingly see more consumer review reports enter the market.

The Local Consumer Review Survey delves into all of the crucial questions. How are today’s consumers searching for and interacting with business reviews? Which review elements are most important to consumers, and how do online reviews measure up against personal recommendations?

If you’ve been an avid follower of our consumer review research, you’ll recognize there are some questions we ask most years. This allows us to collect that juicy year-on-year trend data that shows how things may—or may not—be changing.

But we also want to keep things fresh. The review landscape continues evolving, so we always aim to dig into the latest developments and bring brand-new insights to support your reputation management endeavors, be you a big brand, small brand, marketing consultant, or business owner.

Here are just some of the key findings you can expect from the Local Consumer Review Survey 2024.

Key Themes and Findings

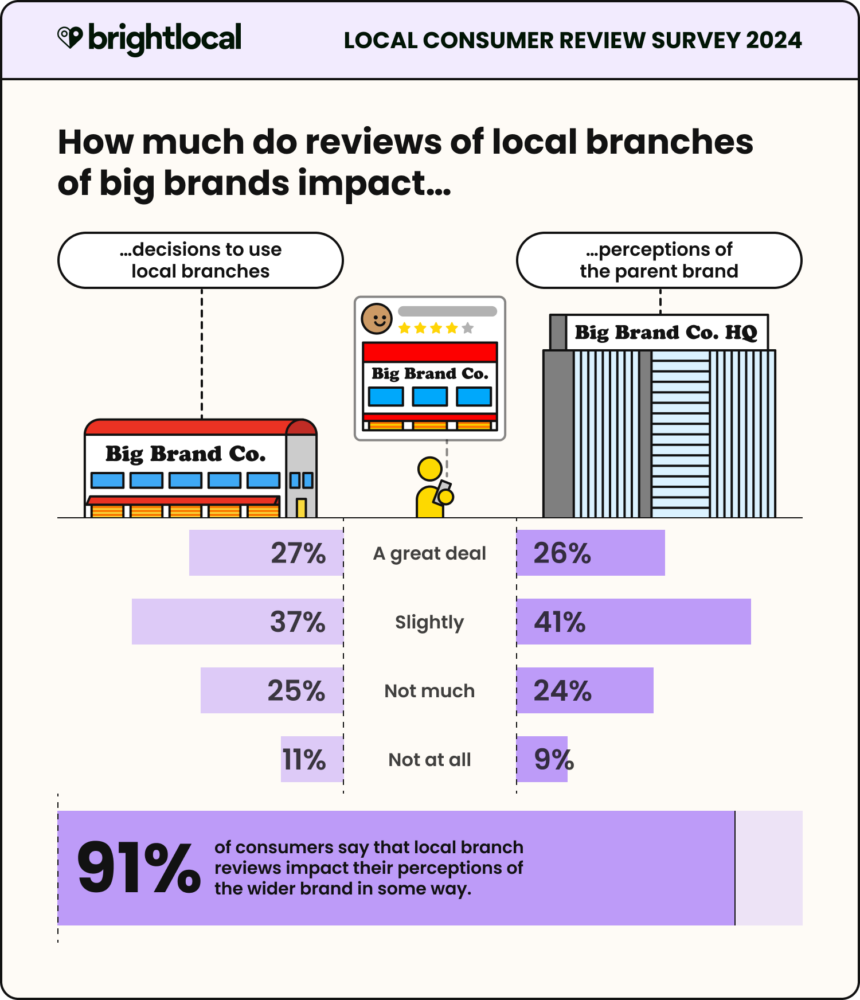

- Local reputation for big brands matters: 91% of consumers say local branch reviews impact their overall perceptions of big brands in some way.

- Business review responses are crucial: 88% of consumers would use a business that replies to all of its reviews, compared to just 47% who would use a business that doesn’t respond to reviews at all.

- Generative AI can be a helpful review response assistant: 58% of consumers preferred the AI-written review response when shown one written by a human and one generated with AI.

- Social media continues to be a big part of consumers’ business research journeys: 34% of consumers use Instagram, and 23% use TikTok as alternative local business review platforms.

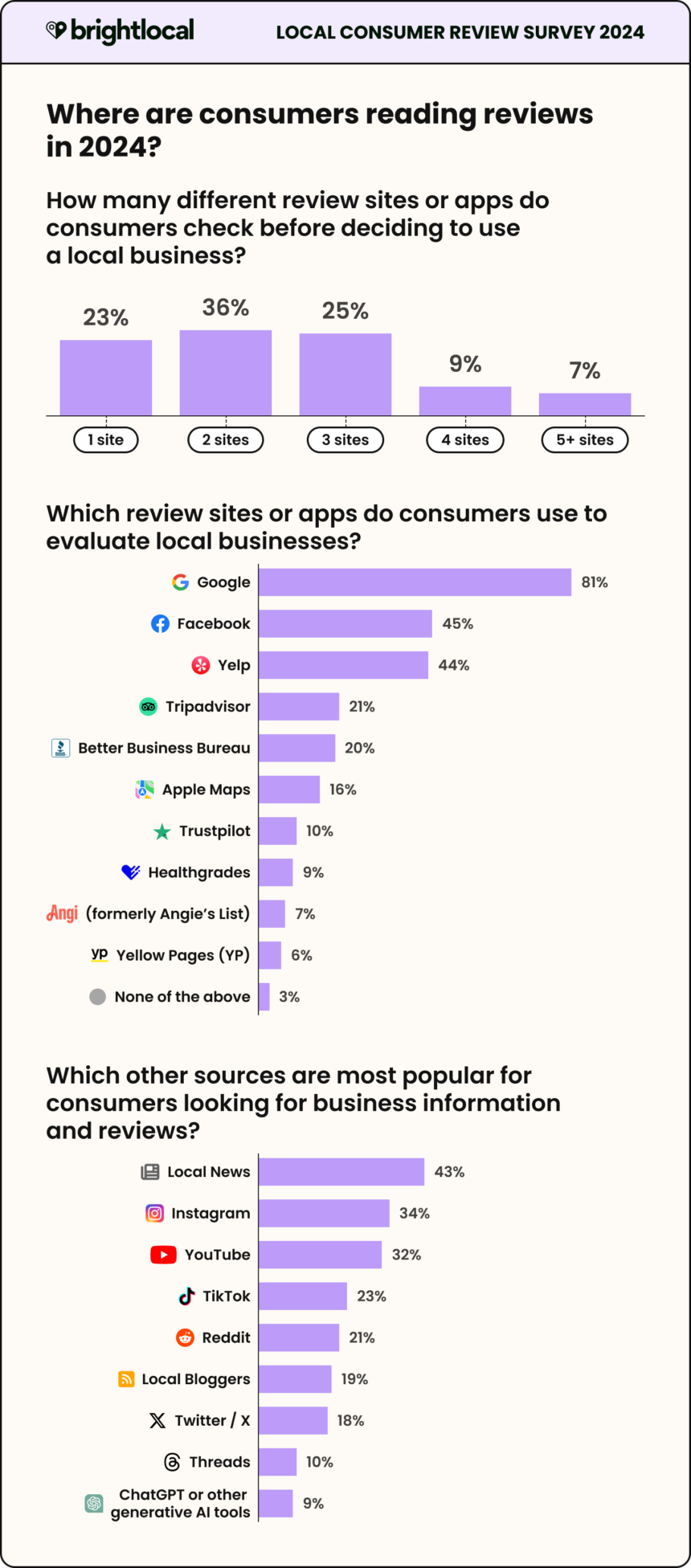

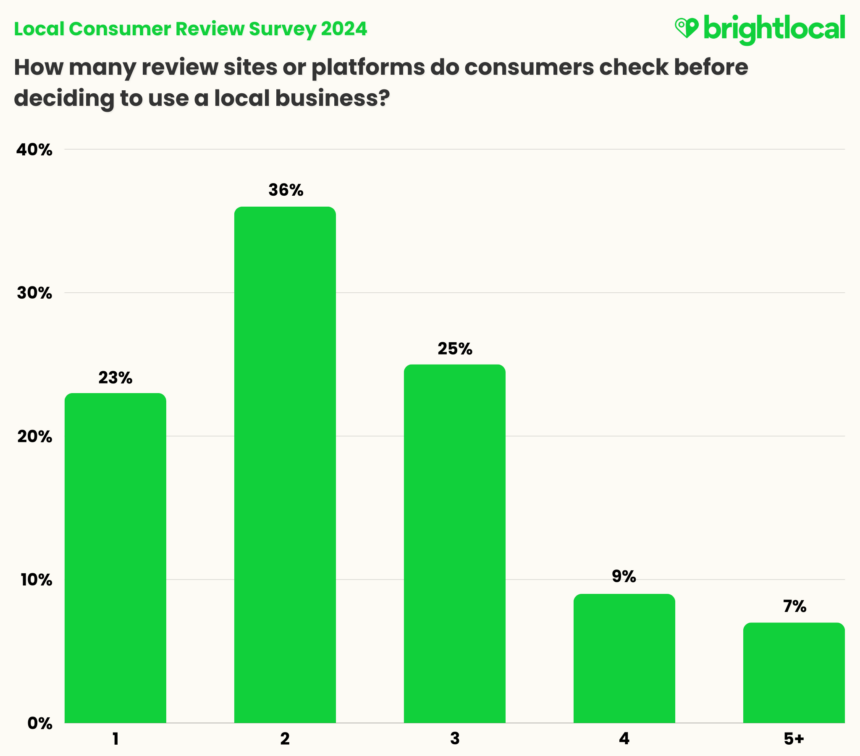

- Consumers typically use two or more sites to check business reviews: 36% of consumers use two review sites when deciding to use local businesses, while 41% of consumers use three or more sites.

Finding and Using Business Reviews

How often are consumers reading online reviews?

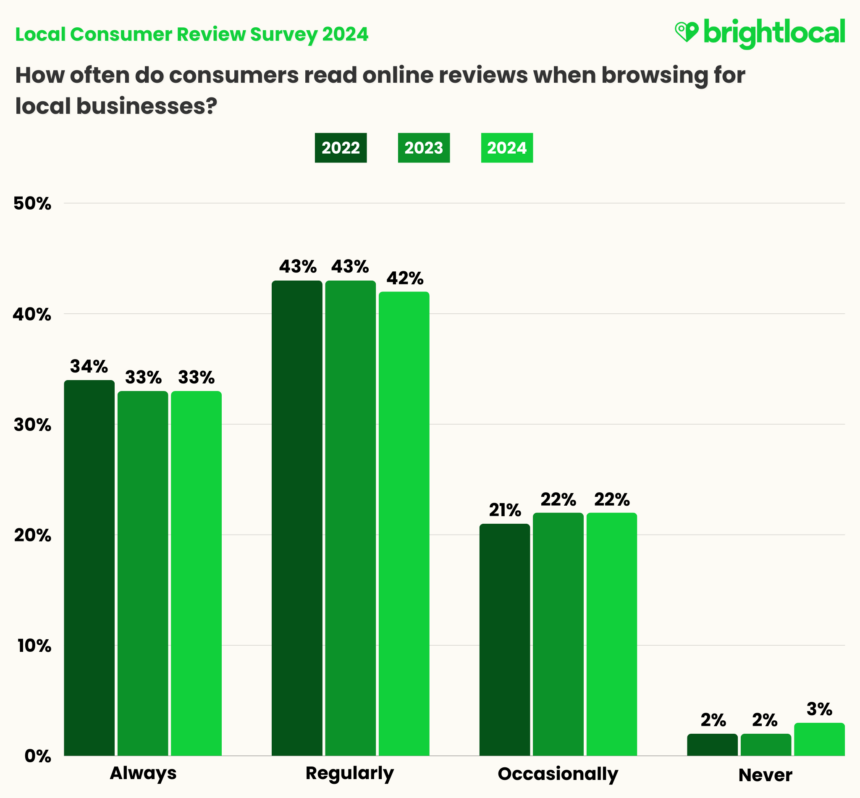

By asking how often consumers read consumer reviews during their business research process, we can get a clear picture of how important reviews are to their decision-making.

The chart above shows that the percentage of consumers ‘always’ or ‘regularly’ reading online reviews has held fast over the last three years (75% in 2024 against 76% in 2023).

Meanwhile, just 3% of consumers say they ‘never’ read online reviews, reflecting how ingrained reviews are in most consumers’ business research.

Where are consumers reading online reviews?

The review landscape has expanded in recent years, with many brands and apps incorporating review functionalities to support purchase decisions.

In terms of ‘official’ review platforms, several long-standing sites are prominent in the USA (and beyond).

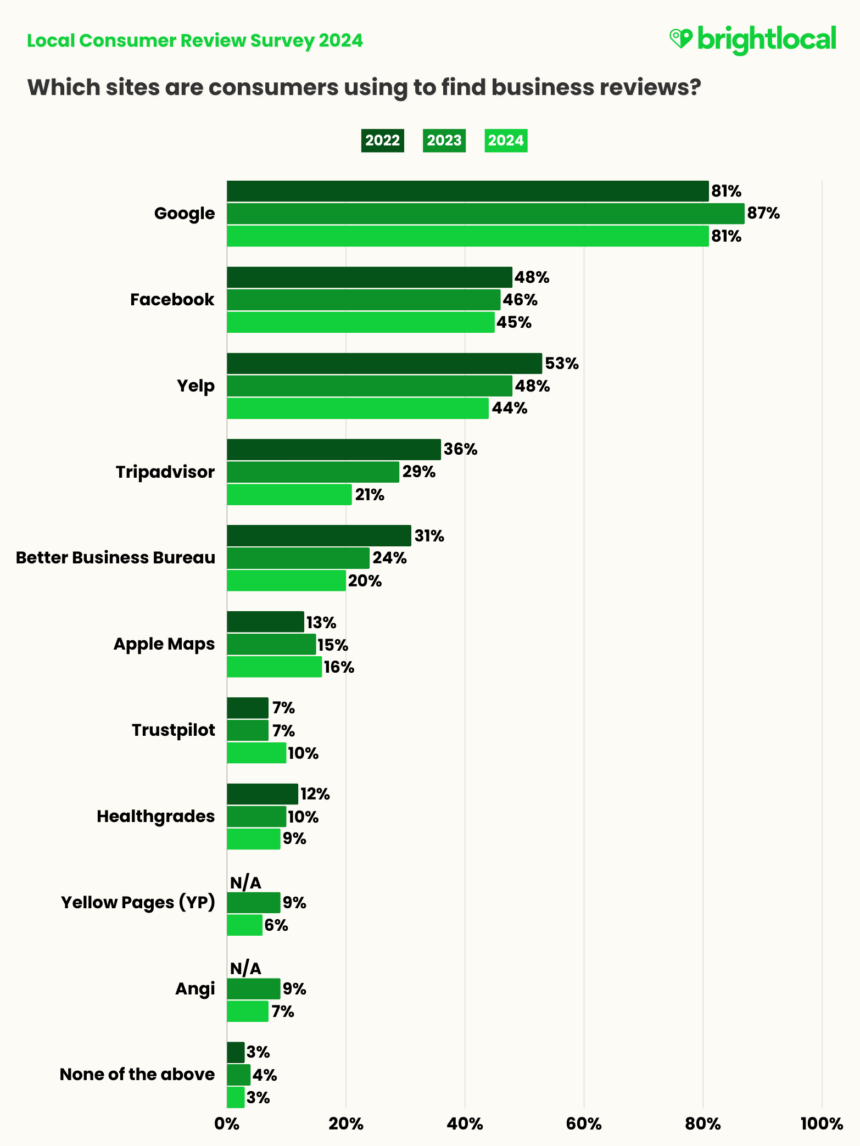

- Google remains the most-used website for reading online reviews, although the percentage of consumers using it for this has dropped from 87% in 2023 to 81% in 2024.

- Consumer use of Apple Maps and Trustpilot has increased by 3% since 2022, from 13% to 16% and 7% to 10%, respectively.

It won’t surprise many that Google remains at the top of the list for consumer review sites. The search giant is still, by far, the biggest review platform today.

What’s more interesting is where we see a downward trend for almost all listed websites and directories, except for Google, Apple Maps, and Trustpilot.

Despite remaining in the top three most-used platforms, Facebook and Yelp have seen decreases in percentage points over the years—3% for Facebook since 2022 and 9% for Yelp. The gap between the two has also become much closer in 2024, with consumer use of Facebook for online reviews overtaking Yelp for the first since time 2020.

Back then, we noted that the dip in consumers using Yelp may have been caused by the impact covid-19 had on physical businesses like restaurants, hotels, and entertainment. It’s not entirely clear why the percentage of consumers using Yelp in 2024 is lower, however.

The use of Tripadvisor and Better Business Bureau (BBB) has dropped significantly since 2022. Both platforms are typically known and used for industry-specific reviews: Tripadvisor for hospitality and entertainment business reviews and Better Business Bureau for professional trades and service-area businesses (SABs).

As the most widely-used review platform, it could be that Google continues to eat the market share of other review platforms as it becomes more helpful to users. For example, Google and its business profile management product, Google Business Profile (GBP), introduced notable features over the last year that enable businesses in particular niches to optimize their listings. Price comparisons, booking availability, and business amenities are now prominent features of hotel business profiles, and SABs can set service areas and make specific services prominent on their profiles.

Finally, Apple Maps and Trustpilot are the two platforms that beat the downward trend and show increasing consumer use instead. In early 2023, Apple announced Apple Business Connect, a late-coming rival to GBP. As we reported at the time, businesses have been slow to claim their business profiles, and a quick poll found that only 12% of consumers used Apple Maps over Google Maps.

New features and an improved Apple Maps interface, including more appealing iconography to distinguish business types, could explain why we are seeing an increasing trend in consumers using this app.

Meanwhile, while Trustpilot is an open review platform, businesses often invite verified customers to review their customer service experiences. These reviews are clearly labeled as ‘Invited’ or ‘Verified’. The increase in consumers using Trustpilot to read reviews could be related to a desire to read verified—or perhaps, to them, more trustworthy—reviews.

How many sites do consumers check reviews on?

Despite noting a downward trend in the use of some review platforms, we wanted to see how many sources consumers used to read reviews on average.

- 77% of consumers use at least two review platforms in their business research.

- 41% of consumers use three or more review platforms.

Less than a quarter of consumers only use one review site before choosing a local business. This finding is particularly significant as it reinforces the need to ensure your brand is represented consistently across multiple review platforms.

When asking consumers for business reviews, providing them with several options is a good idea. As we know from the responses to the previous question, consumers have preferences and may have accounts with particular platforms. Giving them options and making the process as simple as possible can encourage them to leave reviews.

Consistent Business Information Builds Trust

Maintaining multiple review profiles is a key local marketing tactic. Not only does it ensure your presence on structured business listing sites (crucial for your local visibility and rankings), but it also means that consumers can find an accurate reflection of your brand wherever they look.

In the Local Business Discovery and Trust Report 2023, consumers highlighted that correct and consistent business information was necessary for building trust with a business.

Where else do consumers source business reviews?

When it comes to reviews and recommendations, we have to acknowledge the importance of alternative sources, including the growth of social media platforms like Instagram and TikTok for “unstructured” consumer reviews (i.e. reviews that don’t follow a dedicated review structure or scoring system).

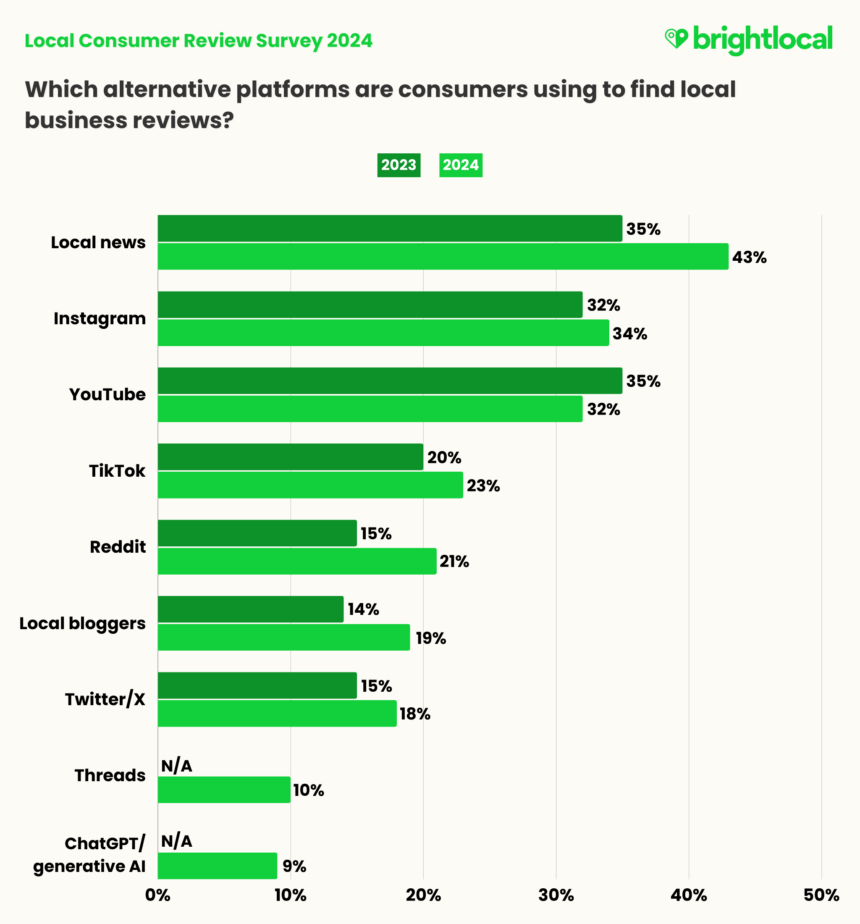

2023 was a particularly interesting year for developments in these areas, with the introduction of Threads, the rebranding of Twitter to X, and the boom of generative AI. This is the first year we included ‘Threads’ and ‘ChatGPT/generative AI’ as responses.

- Local news as an alternative review source has increased by 8% since 2023.

- In 2024, consumers are using Instagram and TikTok for business reviews more, with an increase of 2% and 3%, respectively.

Apart from YouTube, all of the sources we listed in 2023 have seen increases. Most notable is local news—an interesting source, as it could cover both digital and more traditional forms of media, including print, radio, and TV.

Local news and community initiatives are classic local marketing tactics that can support your brand’s visibility in local areas but can also be effective for link-building.

The increase in consumers using various social channels highlights the importance of maintaining your brand’s social presence. Being active and aware of these review alternatives will ensure you can find and respond to reviews and comments, engage with users, and maybe even win new audiences.

Finally, almost 10% of consumers said they’re using ChatGPT or similar generative AI tools as an alternative source of review information. Considering the technology only burst into the mainstream in early 2023, and research in March 2023 found that 73% of consumers had not used generative AI, this is significant.

Generative AI for Local Search

In July 2023, we conducted a case study of several different generative AI tools, specifically in the context of local search. While a lot will undoubtedly have changed since then (e.g. Google Bard is now Google Gemini), there are some insights here on how to get your business cited by generative AI tools.

How Consumers Interact with Review Platform Functionalities

We’ve noted some of the improvements that Google has made to business review platforms to support visibility and show more useful information to prospective customers. Now, we will look at some of the features that make finding the right review content easier.

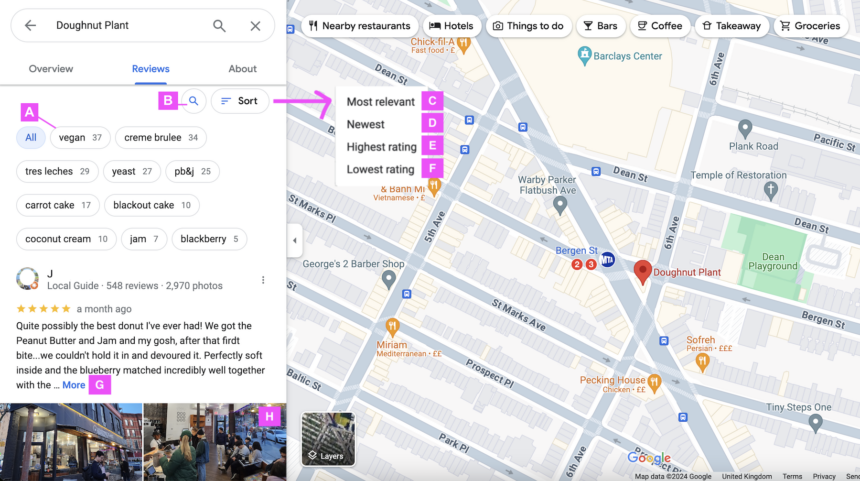

For several years now, users have been able to use a search functionality within Google reviews to look for specific keywords and terms. More recently, it has improved filtering with ‘mentioned’ keywords, and now initially prioritizes the order of reviews shown on the default filter based on what it deems ‘most relevant.’

We provided consumers with an image of reference (below) and labeled eight prominent review features, asking consumers how useful they found each one when searching for business reviews on Google.

- 96% of consumers said that the ’search reviews’ function is useful to them in some way.

- ‘Sort by newest’ is deemed the most useful review function, with 47% of consumers finding it ‘highly useful.’

Clearly, all of the functions shown to consumers are useful in some way. The largest percentage of consumers who do not find a feature useful at all is 15% for a ‘highlighted’ review. From this, we can assume that consumers prefer to judge the relevance of the business’ reviews for themselves, rather than being guided by Google.

47% of consumers rated the ‘sort by newest’ function as ‘highly useful,’ which tells us that almost half of consumers consider review recency as important when deciding which business to use.

Although this question is specific to Google review functions, it’s important to note that most prominent review platforms use similar features to support the user experience. The ‘sort by’ functionality is a standard tool across most digital experiences, while keyword filters and search functionalities are present on platforms such as Yelp and Tripadvisor.

So, while we can only discuss the findings above concerning Google business reviews, it’s useful to consider how you can make review functionalities work for you on different platforms.

Functionalities like ‘sort by newest’ and ‘sort by highest rating’ incentivize businesses to actively put more effort into their review profiles, achieving a regular stream of reviews if they know that’s how people filter.

It also reinforces the importance of delivering excellent, memorable customer experiences. If there are things you want your brand to be known for, consider ways you could encourage customers to mention them in their reviews. Dog-friendly places or restaurant menus with particularly renowned items are just two examples users might be looking for.

The Most Important Review Factors

What are consumers looking for when they’re browsing business reviews? Are they looking for a high number of ‘good’ star ratings, or are there other factors that would reassure them before using a business?

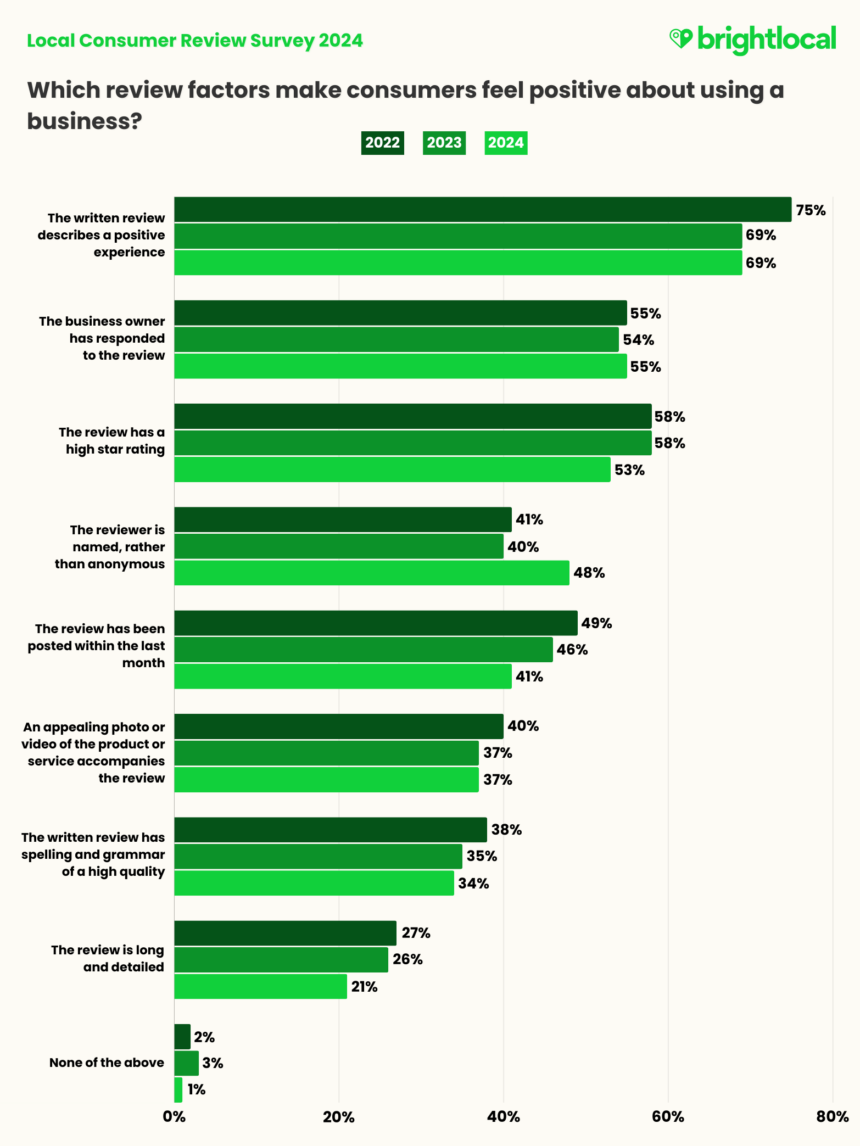

- 69% of consumers would feel positive about using a business if its written reviews describe positive experiences (static against 2023, which was down from 75% in 2022).

- In 2024, 8% more consumers feel positive about a business if its reviews are written by named users than in 2023 (48% in 2024 vs. 40% in 2023).

Overall, there is a downward trend in review factors helping consumers feel positive about using a business. This could suggest that people are less willing to take things at face value.

There has been an increase in the percentage of consumers who said that reviews written by named users—as opposed to anonymous accounts—would make them feel positive about using a business. This points to a general sense of wariness around user-generated content and perhaps shows more digital ‘savviness.’

What star ratings do consumers expect to see?

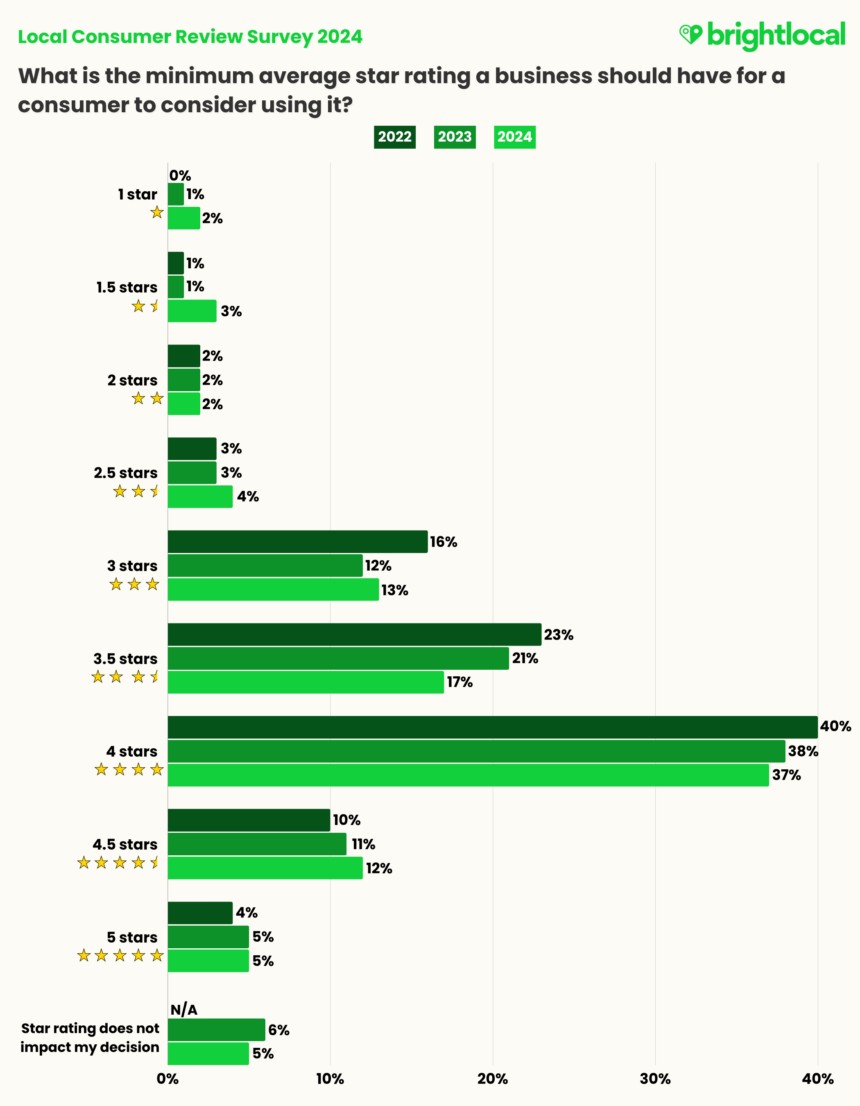

- 71% of consumers would not consider using a business with an average rating below three stars, 16% lower than in 2023.

- 6% fewer consumers would use a business with a 3.5 star rating in 2024 than in 2023.

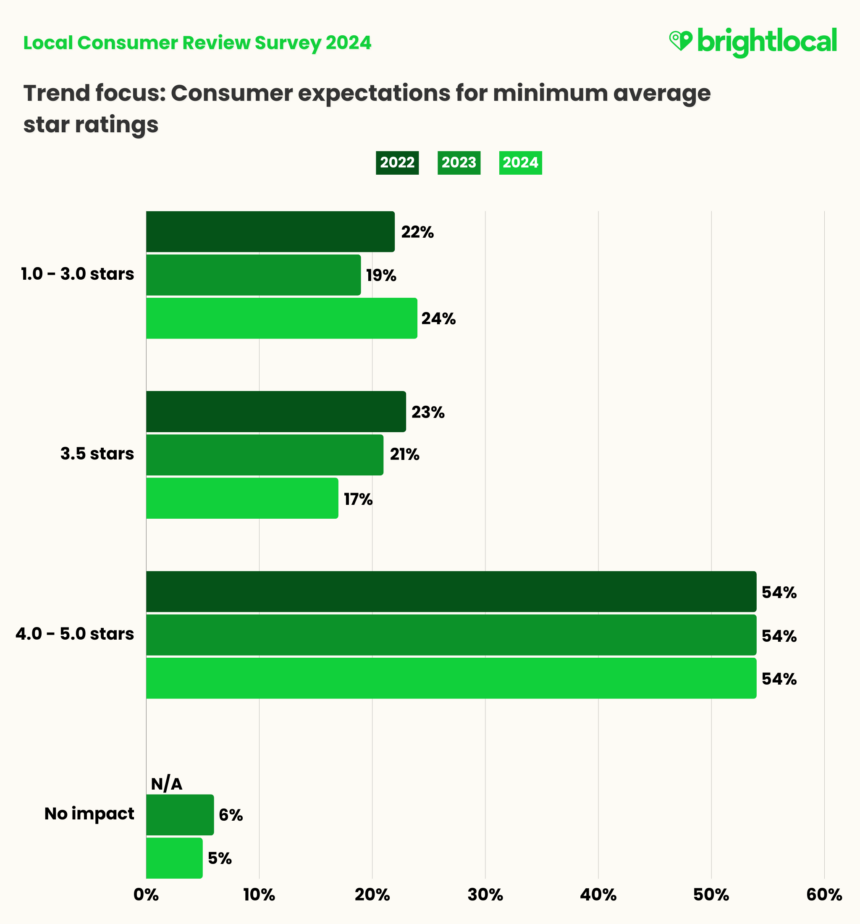

At a glance, there is an upward trend in consumers willing to use businesses with ‘low’ (lower than 3.0 stars) star ratings, and a downward trend where consumers expect ‘high’ (higher than 3.0 stars) star ratings as the minimum.

However, if we examine this further, the majority of consumers still expect a business to have a star rating between 4.0 and 5.0. This figure has remained static since 2022.

The anomaly here is businesses with star ratings of 3.5, where we can see a percentage downshift of 6% since 2022. Could this suggest that consumers are now mistrustful of ratings that sit in the middle?

If a business location has fewer reviews, its average star rating is likely to be skewed by an extremely low or high rating. An increasing willingness to give businesses with low ratings a chance suggests that consumers look beyond face value or are paying attention to review details to reach their conclusions.

There is no denying, however, that businesses should aim for a minimum average star rating of 4.0.

Does the number of reviews matter?

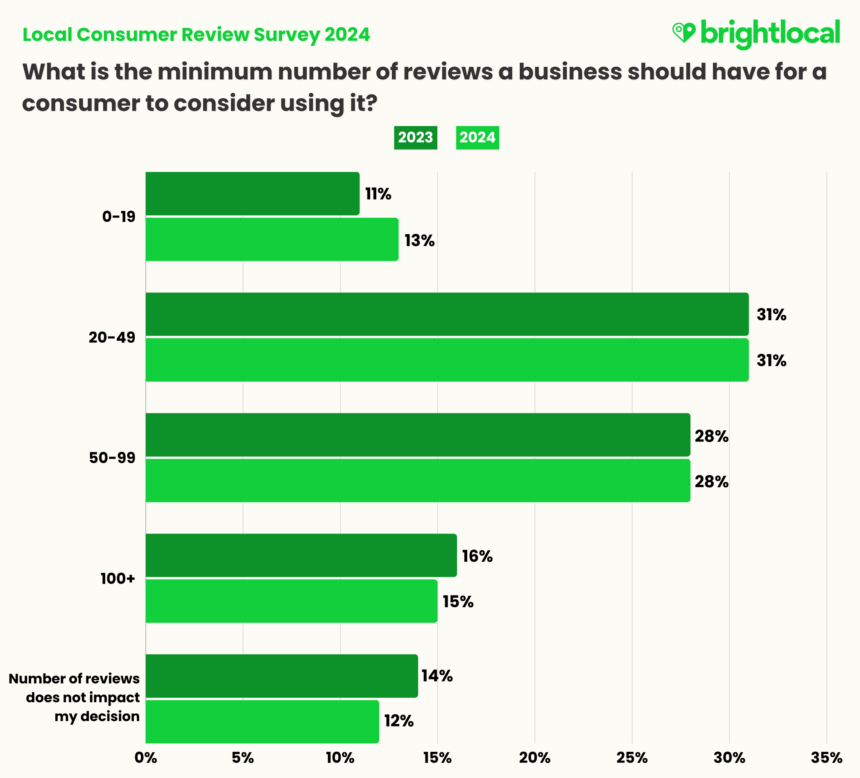

So, how many reviews does a business need to have for consumers to trust the average star rating?

- Most consumers expect a business to have between 20-99 reviews (59%), which has not changed since 2023.

- 12% of consumers said that the number of reviews does not impact the trust in their star rating, down 2% since 2023.

Interestingly, since 2023 there has been a very slight increase in consumers choosing the lower threshold of 0-19 reviews and a similarly slight decrease in consumers saying the number of reviews does not impact their perception.

This hints, once again, that consumers will look beyond ‘at-a-glance’ numbers and ratings to make their own minds up. They don’t necessarily believe in the implied worth of star ratings or how many reviews a business has without reading into the details to verify their impressions.

Almost two-thirds of consumers (59%) said that a business should have between 20-99 reviews in order for them to be able to trust the average star rating. So, while our findings suggest that consumers might be more willing to give businesses a chance, the majority expect between 20-99.

Review Recency

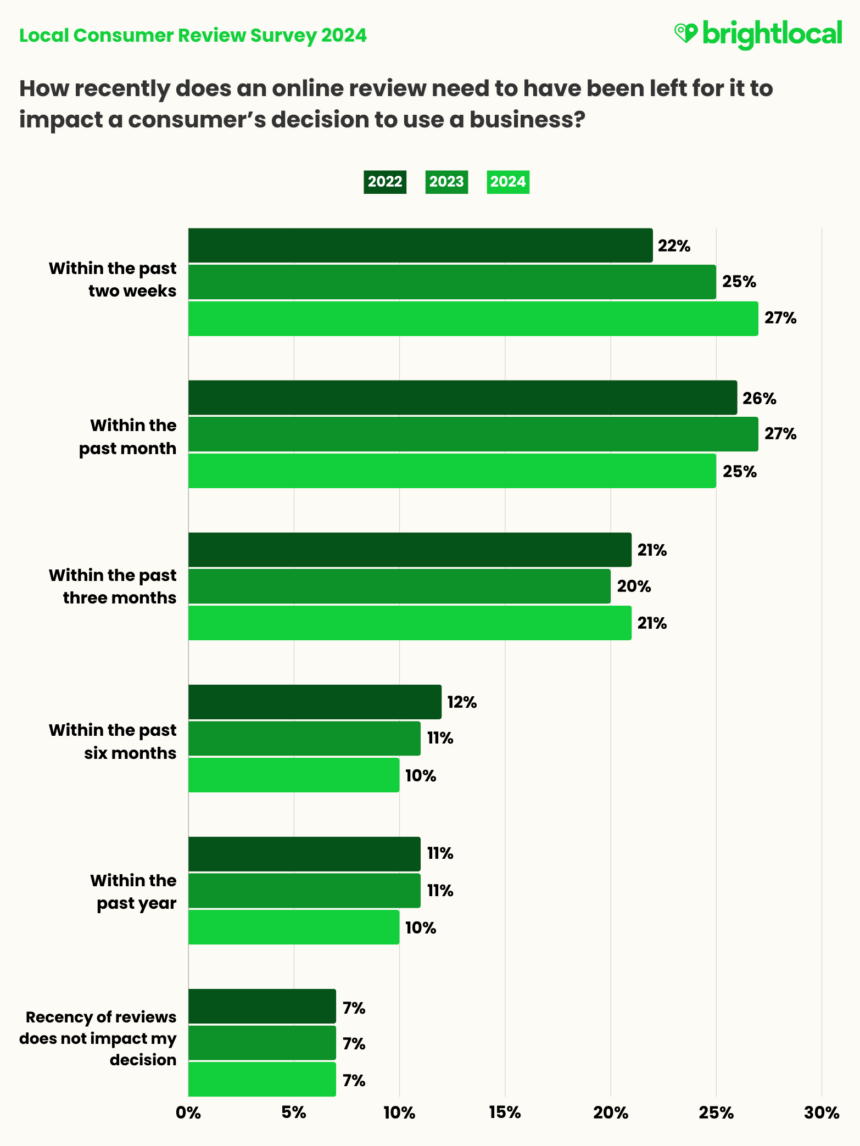

- 27% of consumers expect to see business reviews as fresh as two weeks, up from 25% in 2023, which was up from 22% in 2022.

Expectations of recent reviews is on the up, with 27% of consumers saying that reviews left within the past two weeks impact their decisions, compared to 22% in 2022. Reviews left within the past six months to a year are less likely to impact their choices.

In most cases, it makes sense that this is the expectation. If consumers read business reviews, they want an accurate representation of the most recent experiences with that brand. This will be especially important for businesses within the hospitality industry, including food and drink brands or hotels.

This finding highlights the importance of maintaining a regular stream of incoming customer reviews. A sporadic approach to review requests and followups won’t do, but a more robust reputation strategy or process can help.

Build a 5-star Reputation

Collect, monitor, and respond to reviews with ease

Responding to Consumer Reviews

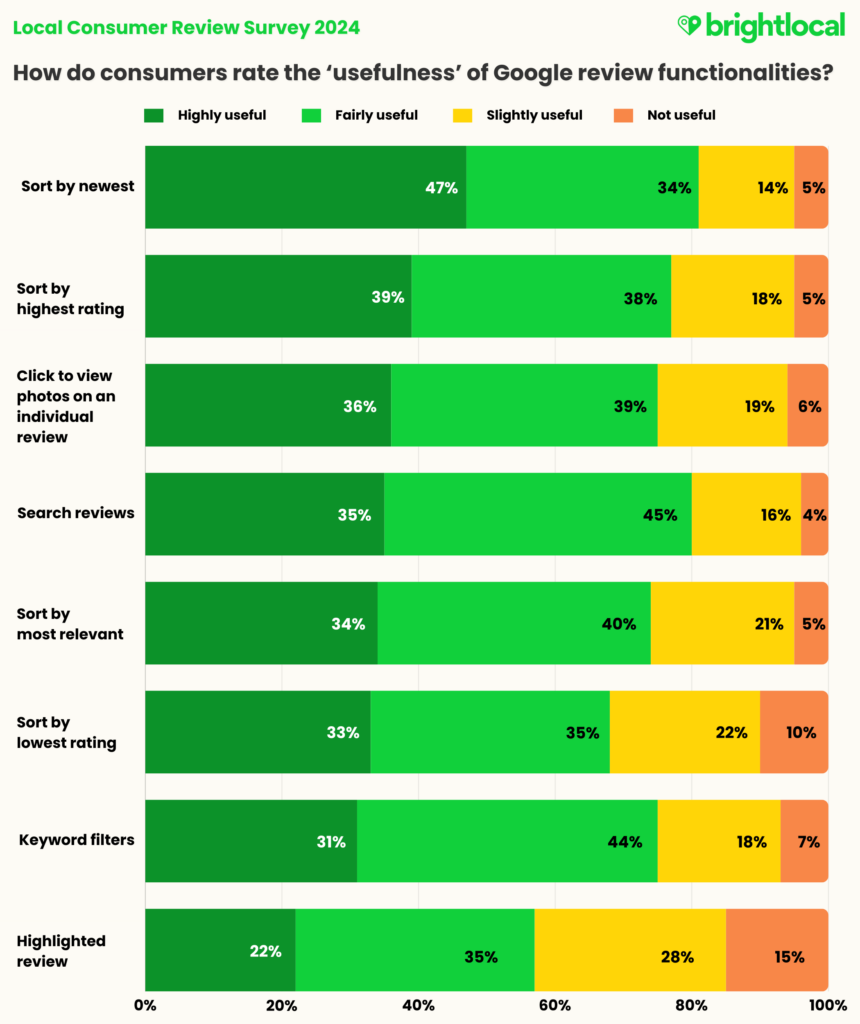

We’ve been discussing review responses for several years, and our findings consistently showed that consumers expect businesses to respond to their reviews. 2024 is no different.

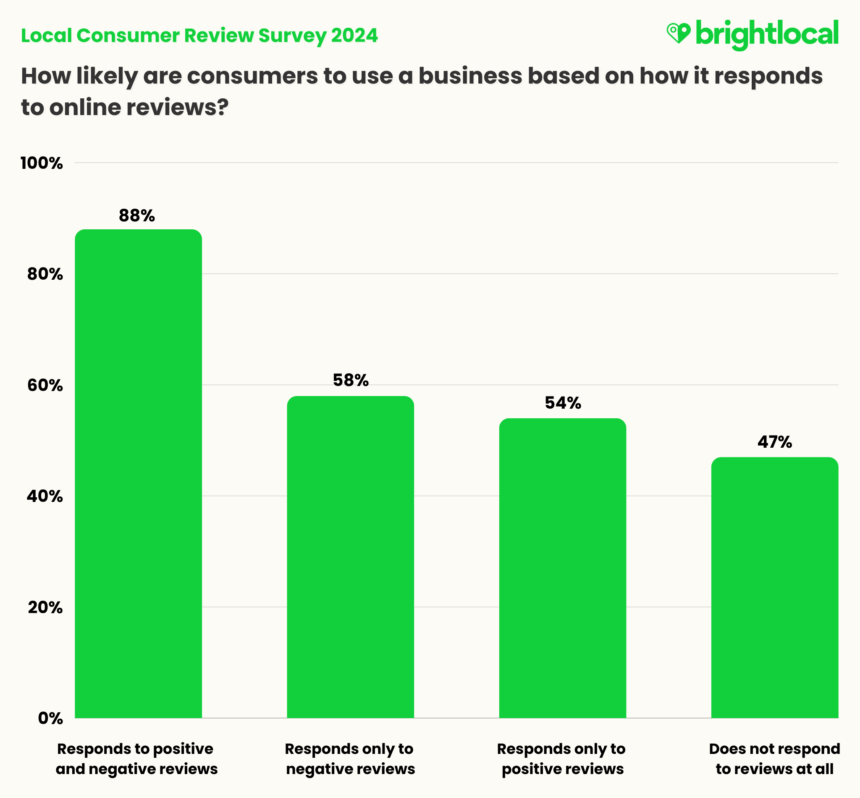

- Consumers are 41% more likely to use a business that responds to all of its reviews than a business that doesn’t respond to any.

The chart above clearly indicates that review responses matter to customers. 88% of consumers would use a business that responds to both positive and negative reviews, compared to just 47% that said they would consider using a business that doesn’t respond to any reviews.

Some consumers may see a business only responding to bad reviews as an attempt to save brand reputation without acknowledging the opinions of others. Similarly, consumers may see a business only responding to good reviews as just amplifying good feedback in order to gloss over the negative.

Either approach can appear inauthentic, and consumers today are clearly pretty savvy when detecting this.

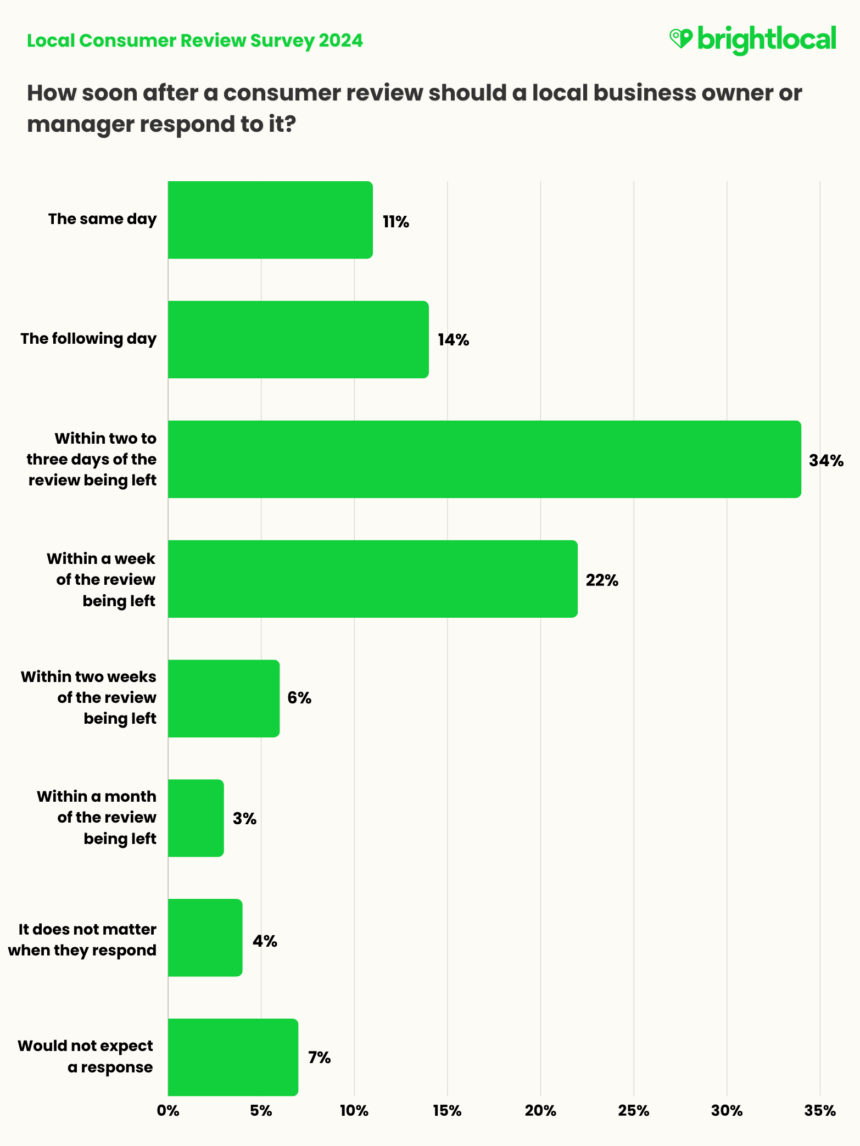

As we know that review responses are an expectation in consumers’ minds, we wanted to find out if it was important when business owners respond to reviews.

- 93% of consumers would expect a business to respond to their reviews.

- 34% of consumers expect a response to their reviews within two to three days of posting.

A mighty 93% of consumers expect businesses to respond to their reviews! So, if this has not been a part of your reputation management strategy so far, take this as a call to action.

Meanwhile, 87% of consumers said they expect review responses within two weeks, and only 4% feel it doesn’t matter when they receive one. This clearly shows how important timeliness is.

The Power of Generative AI in Reputation Management

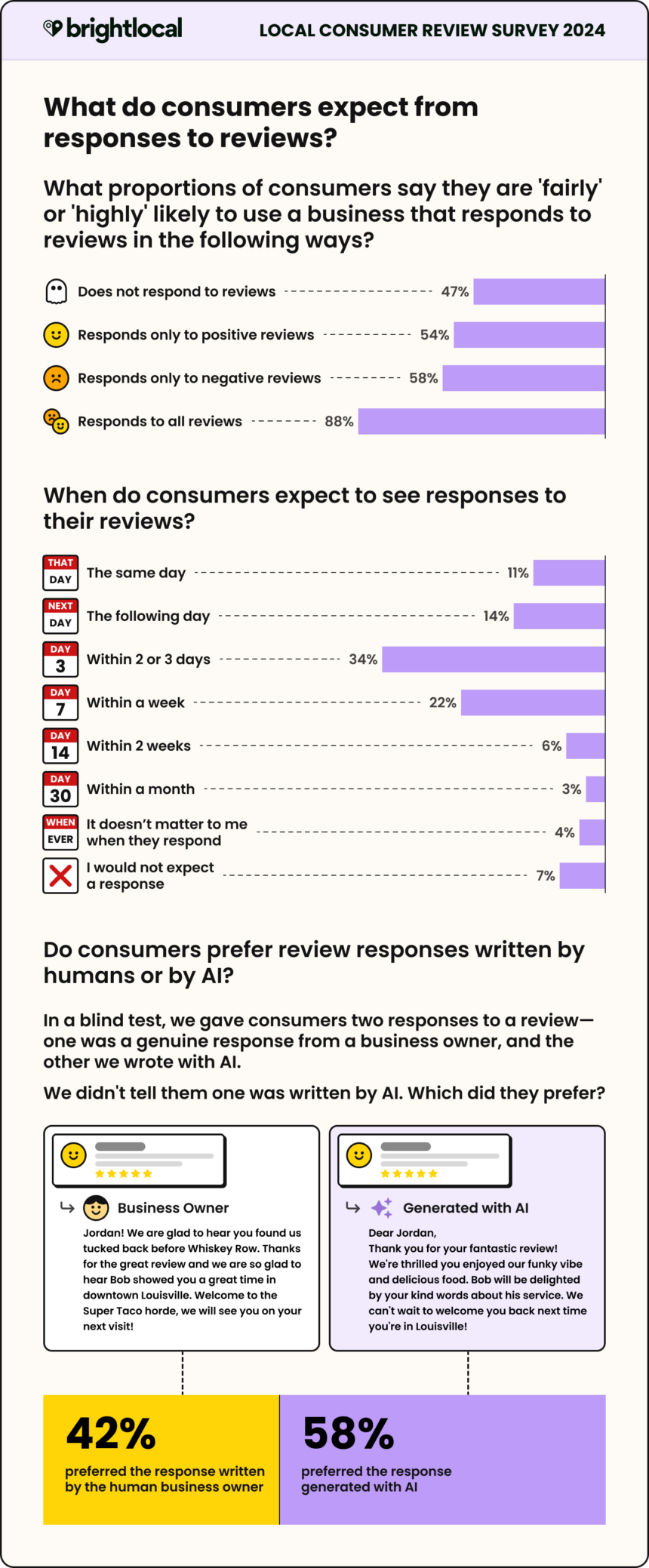

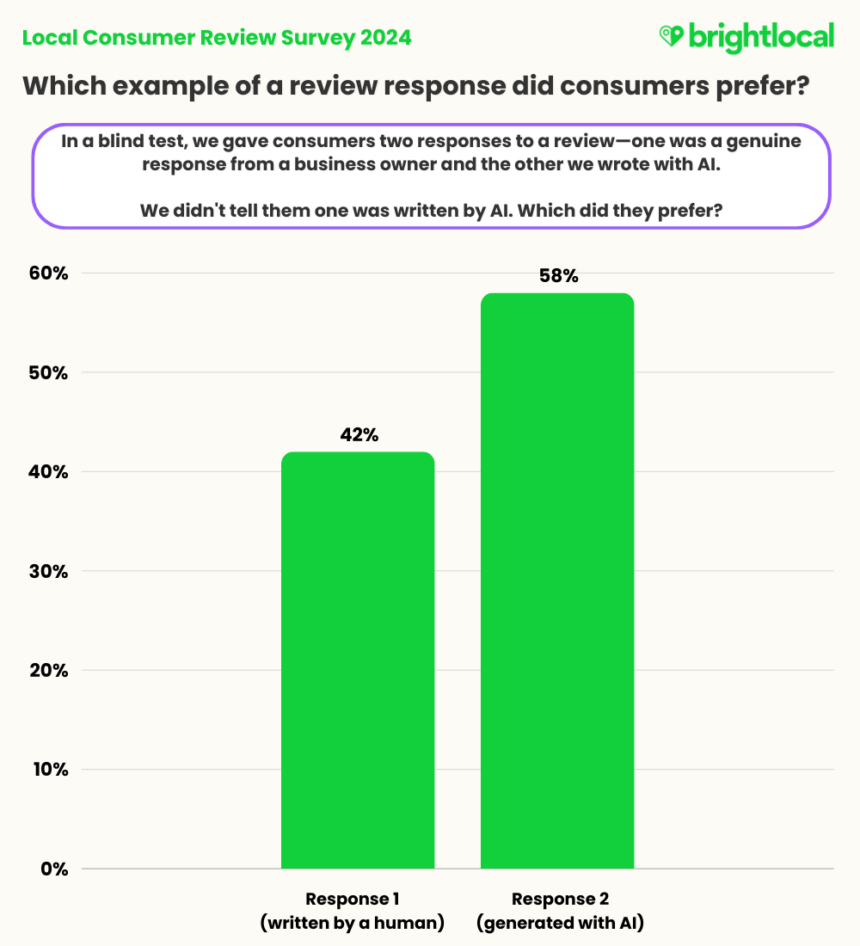

Back to the subject of AI… in this year’s survey, we wanted to test something a little different.

We presented consumers with a business review sourced via Google. Then, we showed them two review responses and asked them to choose which response they would prefer to receive.

Your turn! Which response would you prefer?

Imagine your name is Jordan, and you have written this positive review for a Mexican restaurant:

“My husband and I stumbled upon this gem for lunch. It has a funky, fun vibe we noticed as soon as we walked in the door. We ordered the chips and dip and brisket tacos. The food was all delicious. Our server, Bob, was very friendly and knowledgeable about the local area and surrounding areas. We had a pleasant experience and will come back next time we are in Louisville.”

Which of the following review responses would you prefer to receive?

- Response 1:

Jordan! We are glad to hear you found us tucked back before Whiskey Row. Thanks for the great review and we are so glad to hear Bob showed you a great time in downtown Louisville. Welcome to the Super Taco horde, we will see you on your next visit!

- Response 2:

Dear Jordan, Thank you for your fantastic review! We’re thrilled you enjoyed our funky vibe and delicious food. Bob will be delighted by your kind words about his service. We can’t wait to welcome you back next time you’re in Louisville!

What the consumers didn’t know about these options is that one (Response 1) was the human response sourced from a genuine business owner on Google, and the other (Response 2) was a review response that we generated using ChatGPT.

58% of consumers unknowingly chose the AI-generated review response as their preferred response! Of course, there are many reasons why someone might prefer the content and sentiment of one written response over another.

When we considered the reasons behind their preferred response, it was interesting to note the sense of over-familiarity conveyed in response 1, compared to the more measured sentiment in response 2. Would you agree?

We can’t say what prompted this finding, but it highlights an interesting use case for marketers who may struggle with crafting unique review responses at scale.

Trust in Business Reviews

One of the most prominent themes that reports such as this surface is the importance of consumer trust in brands. While brands cannot actively control the content of the reviews published by other consumers online, we know there are many ways to manage the reputation process.

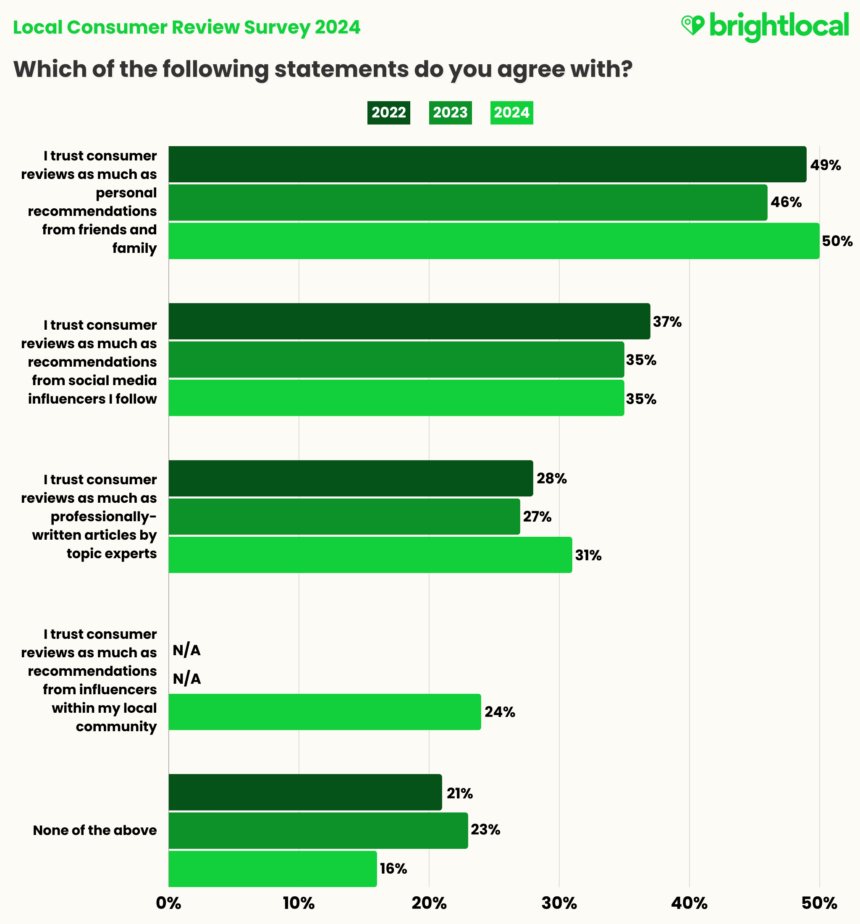

So, where do reviews sit in consumers’ minds compared to other types of recommendations?

Reviews vs. Recommendations from Other Sources

- 50% of consumers trust reviews as much as personal recommendations from friends and family.

- This is the first year that ‘I trust consumer reviews as much as recommendations from influencers with my local community’ was included as a response to this question.

The percentage of consumers who said they trust reviews as much as recommendations from family and friends has increased by 4% since 2023. It’s a significant finding, showing that half of consumers feel online reviews carry as much sway as personal recommendations.

For this year’s report, we wanted to distinguish between social media influencers and local influencers—essentially, macro vs. micro-influencers. We wanted to learn: is there a significant difference between well-known social media influencers endorsing a brand and influencers within the local community?

We found that the percentage of consumers who said they trust reviews as much as social media influencers has remained at 35% since 2023. 24% of consumers said they trust consumer reviews as much as local influencer recommendations. This could be lower than social media influencers as we tend to follow local personalities for specific recommendations, like restaurants and bars. If we were to examine the trust in macro and micro-influencers more closely, to look at businesses in different industries, the reasons might be much clearer.

We can see a 4% increase in consumers who said they trust consumer reviews as much as professionally written articles since 2023. This suggests that they verify online reviews against the opinions from other sources they deem trustworthy. This could also show a sense of wariness in terms of trusting influencer-endorsed content.

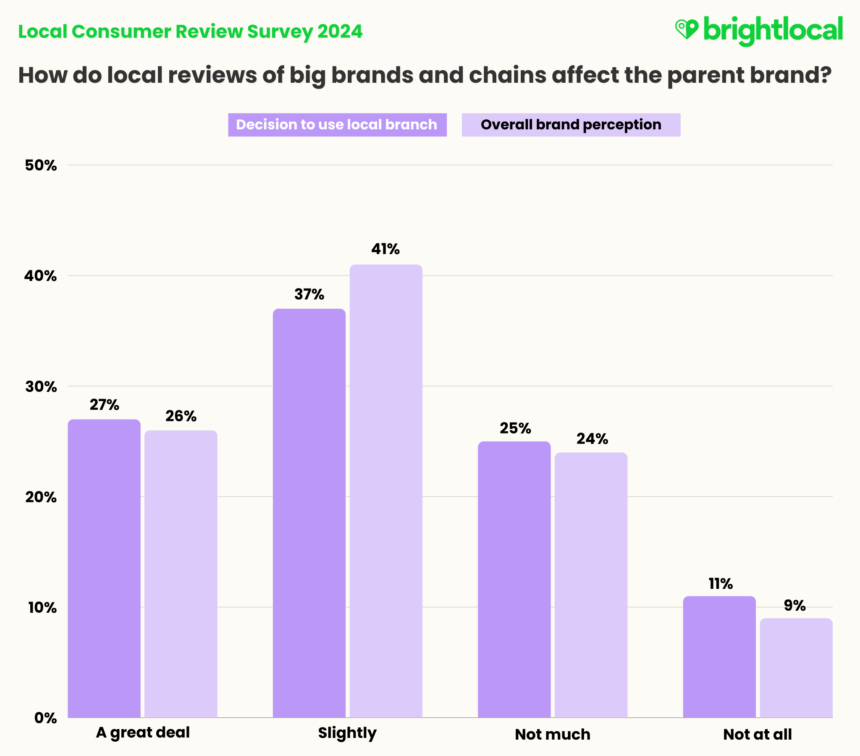

The Impact of Local Reviews on Big-brand Reputation

Another new question we had was how local branch reviews of big brands or franchises impact consumers’ choices, and whether this affects overall brand perception.

For example, if your nearest McDonald’s branch has a Google star rating of 2.0, would you still use that store? And how would that affect your overall perception of the McDonald’s brand?

- 89% of consumers said that the reviews of local branches would impact their decision to use the store in some way.

- 91% of consumers feel that local reviews of chains and franchises impact their overall perception of the brand in some way.

These findings are important because they show that marketers in big brands can’t afford to rest on their laurels in the hope that brand equity will win out. For more than a quarter of consumers, both of these things are true:

- The local consumer reviews of chains or franchises would impact their decision to use it ‘a great deal’.

- The local consumer reviews of chains or franchises would impact their overall perception of the brand ‘a great deal’.

The power of local reputation to impact brand perception should not be underestimated, particularly if we consider the previous findings on how consumers trust personal recommendations from friends and family or those of online influencers.

We explore the review scores of major US brands to see who comes out on top, and delve into review content to identify the themes that make our winners stand out.

Check out The Brand Review Index

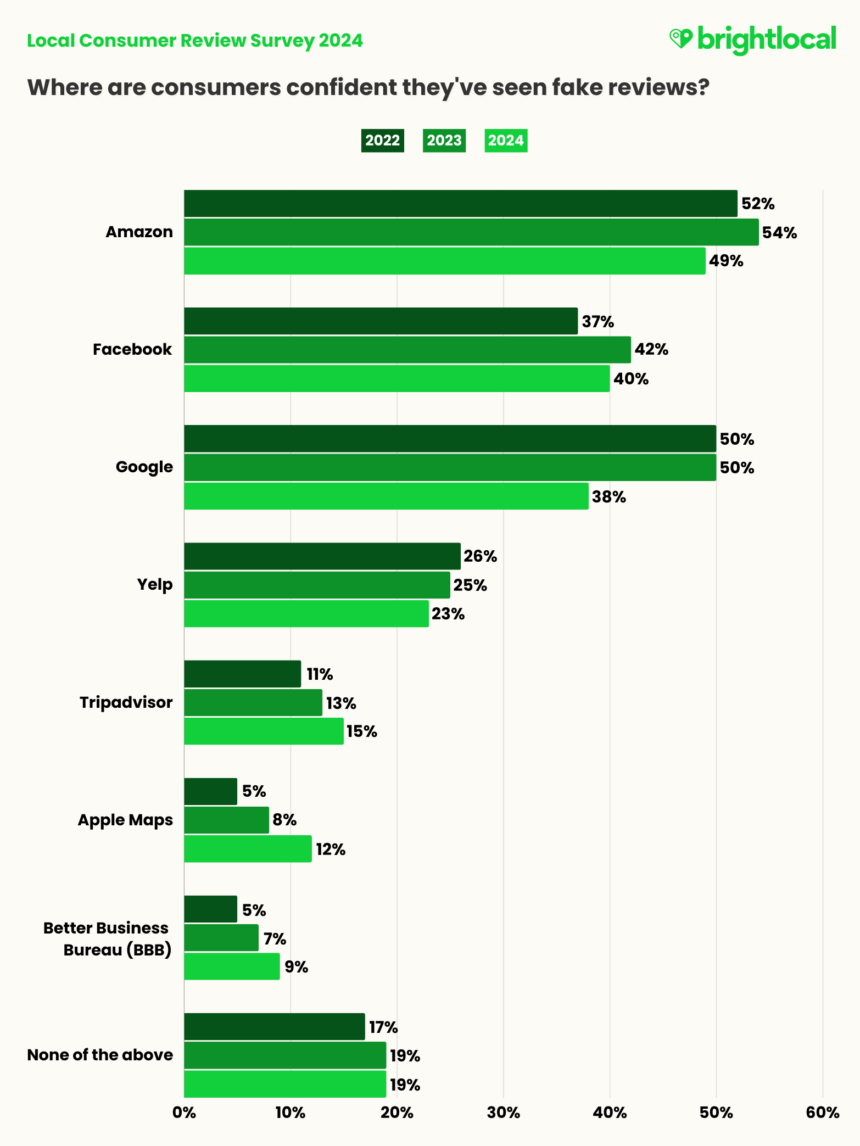

Fake Reviews and Suspicious Activity

Those in the reputation and local marketing game will know the perils of fake reviews. Even those who aren’t will likely have seen the reams of suspiciously gushing product reviews on e-commerce sites such as Amazon—generally known as the biggest culprit for fake reviews.

As we’ve touched on in previous reports, and in our many resources on fake reviews, it’s a real industry problem. Most review and e-commerce sites take the issue seriously as a matter of policy, and Google in particular regularly takes strict action to prevent the practice.

What kind of trends are we seeing fake reviews this year?

Consumers are confident they’ve seen fake reviews across most platforms we asked about. Just 19% said they hadn’t seen any on the sites we provided, which remains static compared to 2023.

Unsurprisingly, Amazon remains the top culprit for fake reviews. However, it’s interesting to note that, aside from Tripadvisor, Apple Maps, and BBB, the percentage of consumers who are confident they’ve spotted reviews on the other review giants has decreased.

This could result from the efforts that platforms have put in to combat the issue in recent years, suggesting that there are genuinely fewer obviously fake reviews on these websites. According to Google, it removed over 170 million policy-violating reviews in 2023, 45% more than in 2022.

Despite a lower percentage of consumers saying they’ve used BBB to read reviews in 2024, there has been an increase in the percentage of consumers who are confident they have seen fake reviews there (9% in 2024 vs. 5% in 2022). The platform itself has recently spoken out on the issue of fake and incentivized reviews, suggesting the practice is becoming notably widespread on different platforms.

Can consumers tell if a review is fake?

A fake review could be left for various reasons. Some businesses pay fake review sellers for positive reviews of their businesses and negative reviews of their competitors, for example.

But fake reviews may also be written by disgruntled customers, employees, or even competitors! In some cases, people might write fake reviews to try to support friends or family, particularly if their business is struggling against negative feedback.

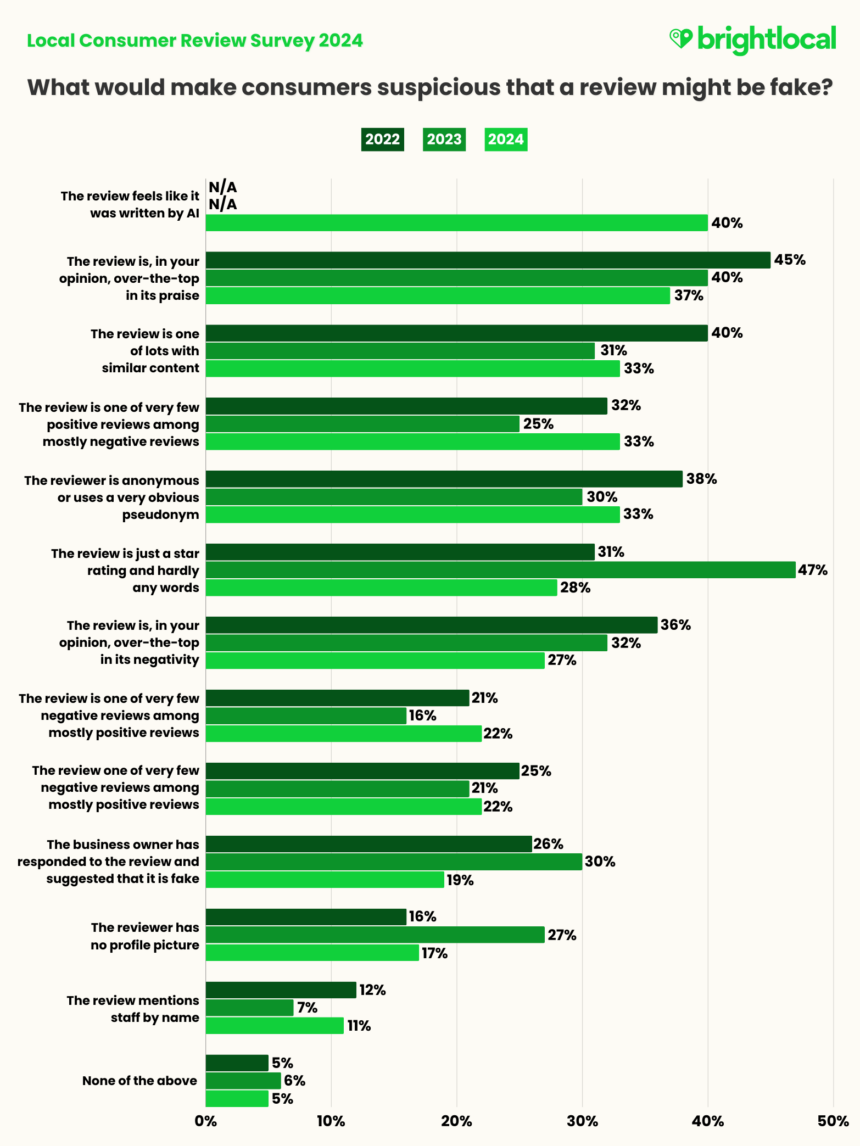

With all these reasons in mind, the content and sentiment of such reviews can vary wildly. There may be a barrage of star ratings with no written context or review content that feels too unbelievably positive or negative, for example. So, which of these would make consumers suspicious that a review is fake?

This year, we introduced the response ‘the review feels like it was written by AI’. Surprisingly, this answer came out top! 40% of consumers said they’d suspect a review was fake if they felt like AI had written it.

It’s an interesting point because, as we know, there are plenty of legitimate use cases for generative AI in content writing. A consumer may feel unable to articulate what they want to say well enough and use generative AI tools for this. It’s also worth considering how, while standalone AI tools such as ChatGPT are available for anyone to use, generative AI is now being incorporated into other software and plugins. The Google Suite and Grammarly are just two everyday examples where generative AI can help predict and improve your writing, making suggestions based on tone and sentiment.

The fact that consumers are collating AI with ‘fakeness’ suggests that there is a misunderstanding in terms of what the technology really is and does. Coupled with AI headlines entering the mainstream press, it’s easy to see how people might reach these conclusions.

However, we also know from our review response test earlier in this survey that maybe consumers prefer the content generative AI can produce. Sure, they didn’t know that’s what they preferred, but it presents an interesting contrast in how consumers act vs. how consumers think.

The remaining results highlight some big contrasts between 2023 and 2024. In 2023, consumers seemed confident that reviews with just ratings and no words would make them suspicious that reviews were fake (47%). This has decreased by 19% in 2024.

They also seem less certain that seeing business owners suggesting a review is fake would make them suspicious of fakeness (19% vs 30% in 2023). Further, they’re now less suspicious of reviews from users without profile photos (17% vs 27% in 2023).

As with the previous question on specific platforms, these responses could result from websites tackling fake review issues or consumers simply noticing fewer fake reviews while browsing. Alternatively, it could point to a greater sense of trust in online reviews.

How Consumers Write Reviews

So, we know how often consumers read reviews to support their business research and the elements they feel are most important to build trust. But how many consumers are leaving reviews themselves? Are they more likely to leave reviews for all experiences, positive or negative, or do they favor a particular type of review?

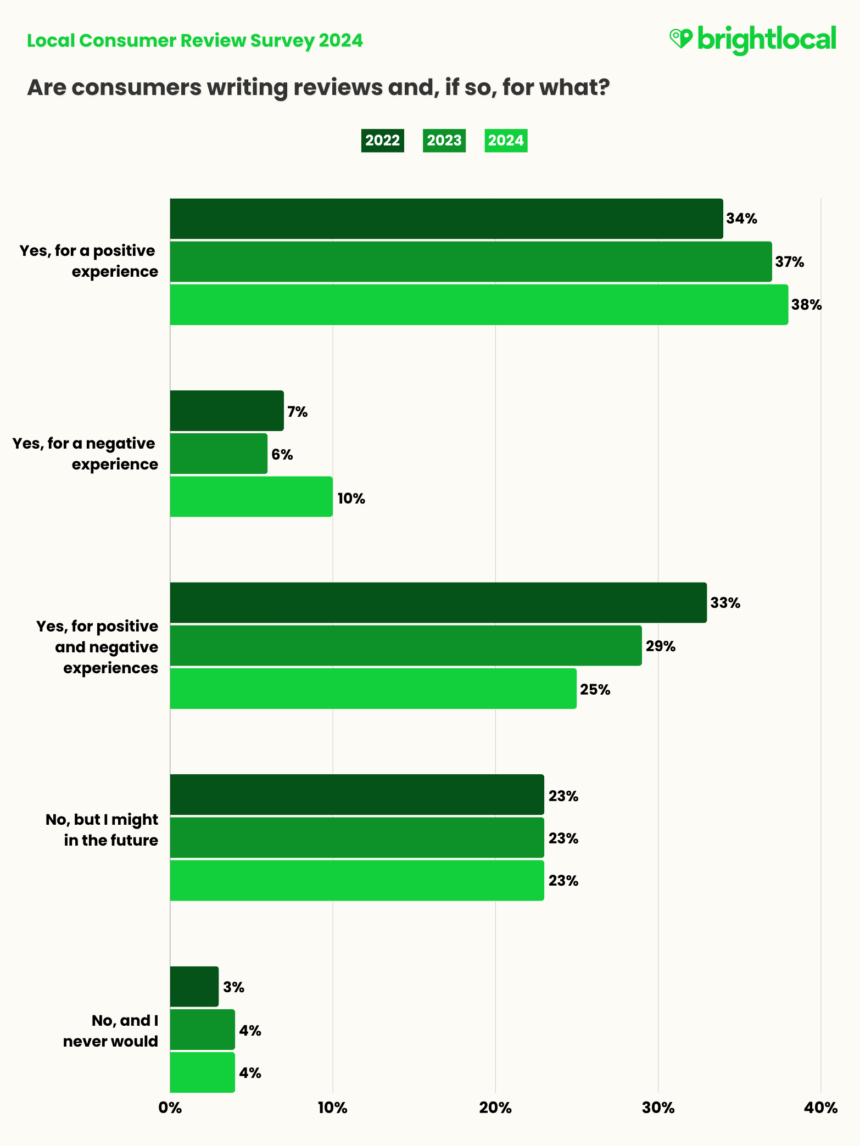

What types of reviews are consumers leaving?

While the numbers are roughly the same as last year, slightly more consumers have written reviews in the past year (73% vs 72% in 2023). The sentiment of these reviews has changed, though.

The chart above highlights a positive shift in the percentage of consumers leaving positive reviews (38% in 2024 vs. 34% in 2022) and negative reviews (10% in 2024 vs. 7% in 2022). The percentage of consumers leaving both types of reviews has decreased from 33% in 2022 to 25% in 2024.

This trend suggests a further waning of the ‘gray area’ between extreme personalities and opinions, as we’ve seen in political discourse over the years (though it would be too far a leap to suggest they’re directly related).

Fewer people are being what you might call ‘balanced’ and leaving reviews for various experiences, and more are getting increasingly set in their ways. The good news is that, right now, there are more consumers only writing positive reviews than negative.

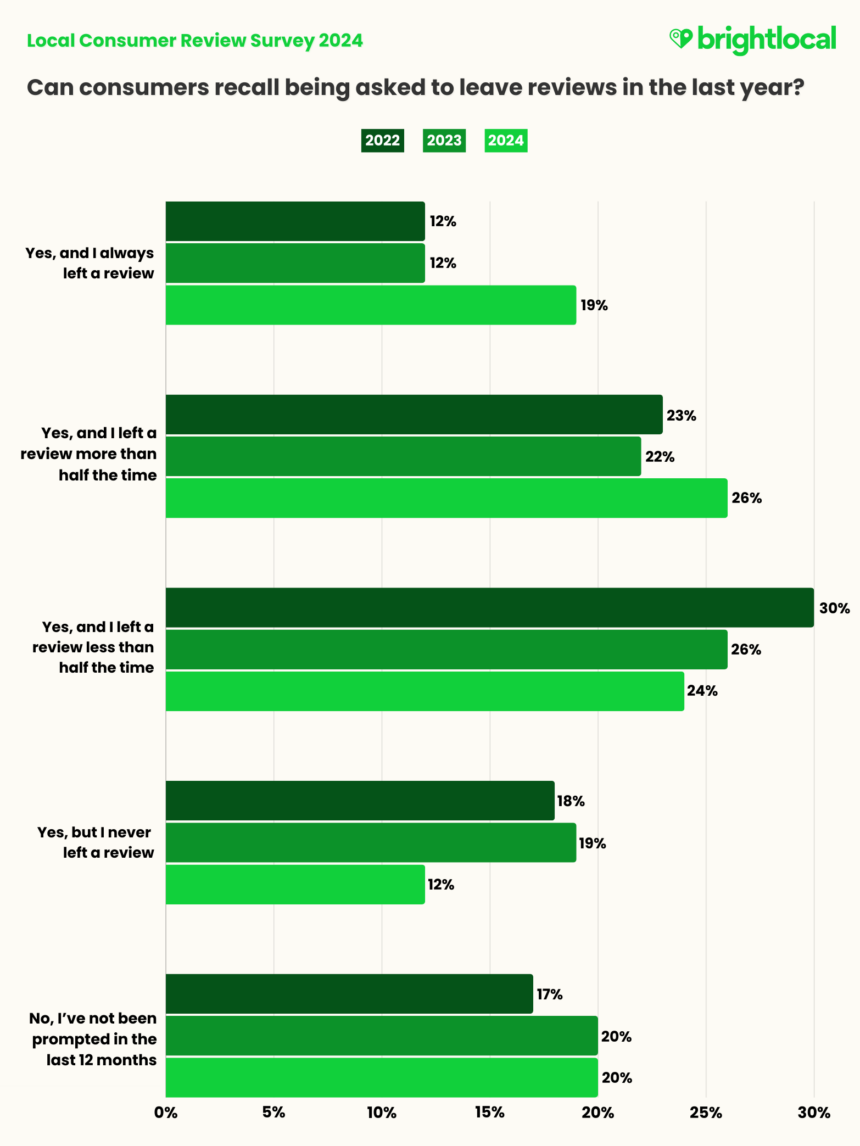

- The percentage of consumers that ‘always’ left a review when prompted has increased from 12% in 2023 to 19% in 2024.

69% of consumers can recall leaving a business review after being prompted by the brand within the last year, vs. 60% in 2023. Coupled with this, only 12% of consumers said they were prompted but did not write a review, compared to 19% in 2023. So, we can infer that more consumers positively respond to review requests in 2024, even if they don’t always write them.

What does this mean for your brand? Well, you may not always be successful, but it is absolutely worthwhile to ask customers for reviews. Nearly seven in every ten consumers will likely write a business review based on the above findings. So, if you aren’t currently asking, you are very likely missing out!

As for how to ask them, and even when, that’s up next.

Asking Consumers For Business Reviews

Knowing how and when to ask a customer to leave a brand review is tricky. Ask too soon, and they may not have had time to reflect on their experience; ask too late, and they may have forgotten about it entirely.

Plus, let’s face it, we all get a lot of review requests these days, don’t we? Multiple prompts in a short window can be irritating, and email inboxes are overflowing with review prompts, promotions, and spam.

So, how do consumers want to be asked for reviews?

Methods of Requesting Reviews from Customers

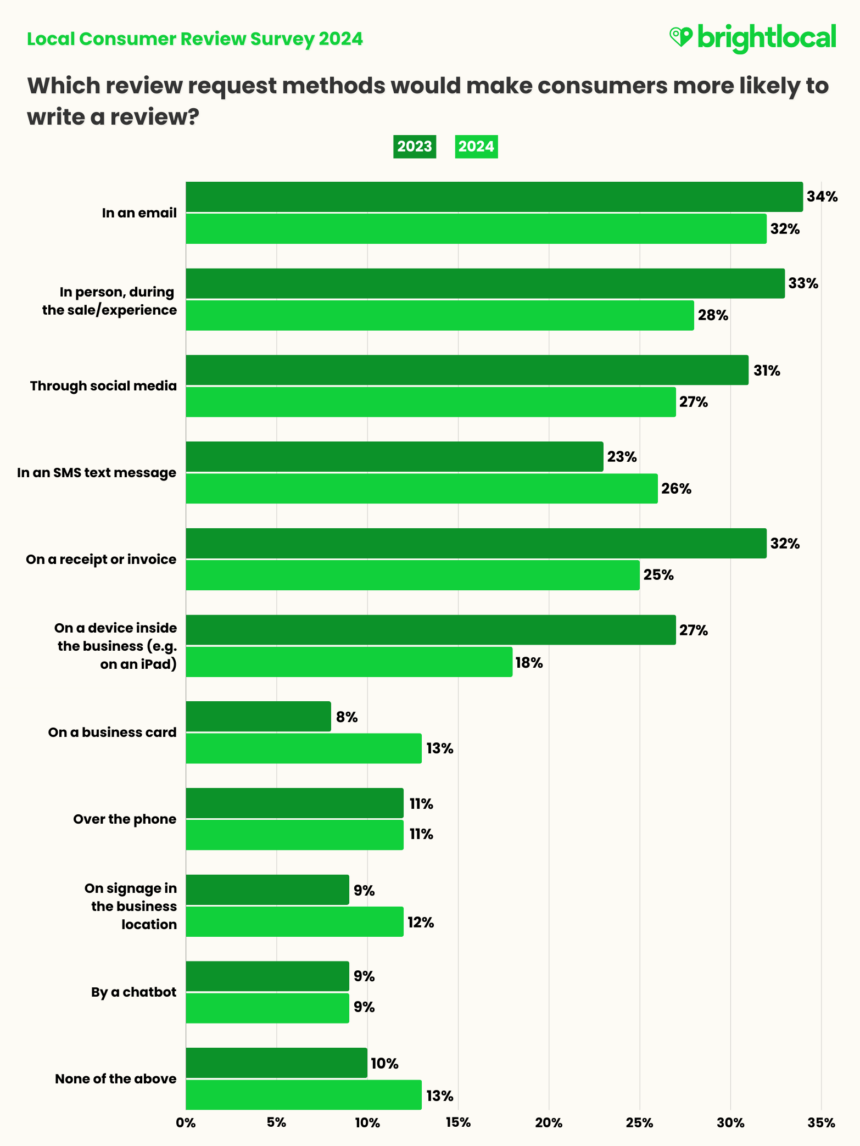

- The top three methods for asking for reviews are: email (32%), in-person (28%), and via social media (27%).

- There has been a 3% increase in consumers choosing ‘none of the above’ when asked about review prompt methods.

Despite email being a busy place, 32% of consumers still say they are more likely to respond to review requests this way. The top three answers from 2023 are the same in 2024 (email, in-person, and social media), although you’ll notice there is a downward trend across all three.

This finding, along with the 3% increase in consumers choosing ‘none of the above’ for review prompts, could point to a sense of review request fatigue. We’re all so used to being prompted to review transactions and experiences that it can run the risk of feeling meaningless.

Brands need to make their requests count by using the right formats, making it simple (as we discussed earlier with the choice of review platforms), making their request stand out from the others, and timing it right.

But when is “right”?

The Window of Opportunity for Review Prompts

We asked consumers when they think brands should contact them with a review prompt, and provided seven different industries where this could differ.

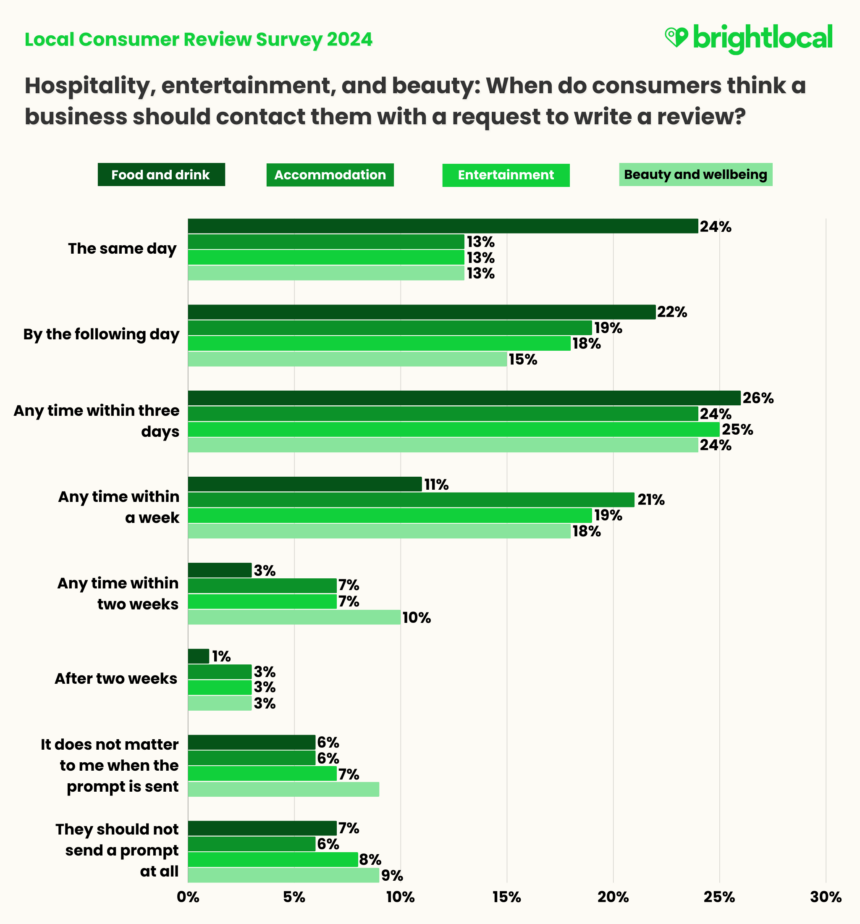

We’ve grouped hospitality, entertainment, and wellbeing together in one chart, as the industries share similarities in how their services focus on providing customers with experiences. Healthcare, professional trades/SABs, and real estate have been grouped in another.

- 24% of consumers expect to be asked to leave a review for food and drink brands on the same day as their experience.

- 48% of consumers said food and drink brands should ask for a review within two to three days of the experience.

‘Food and drink’ stands out as the industry where consumers expect the fastest turnaround for review prompts. Almost a quarter of consumers want these businesses to reach out on the very same day, although the majority would prefer between one and three days.

For accommodation, entertainment, and beauty and wellbeing, we see larger proportions of consumers who think businesses should ask any time within a week.

Our earlier discussion on review recency comes into play here. If you’re planning on visiting somewhere to eat, you’d expect to read about the most recent customer experiences with food and drink brands. It makes sense that consumers would expect these types of businesses to follow up quickly.

The same might be true for recent experiences in the accommodation, entertainment, or beauty industries. However, consumers might require a slightly longer window to reflect on their experiences with these business types—for example, how well a particular beauty or cosmetic treatment lasts.

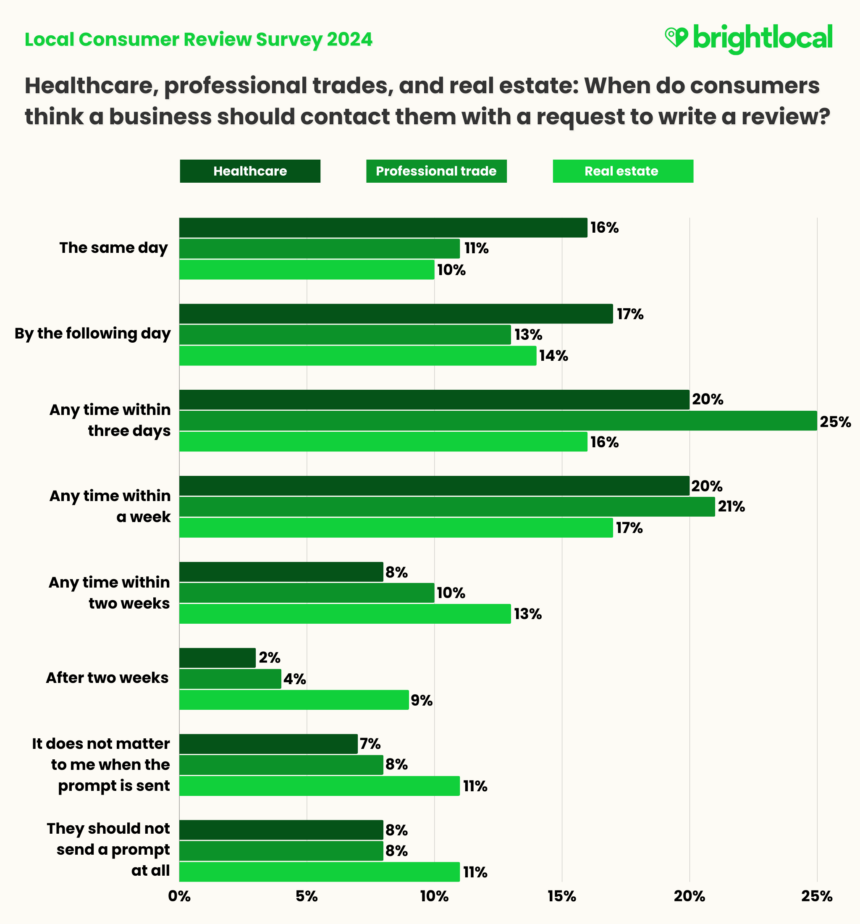

- Healthcare review prompts should be sent within three days to a week (40%).

- 11% of consumers would not want to be prompted to leave a review for a real estate experience at all.

For healthcare, professional trades, and real estate, consumers would expect slightly longer windows before brands reach out to ask for a review, although within three days to a week is the sweet spot.

40% of consumers said they would prefer healthcare brands to ask within three days to a week. Given the nature of some healthcare services and procedures, it feels accurate that consumers wouldn’t want to receive prompts too soon after an experience.

The key takeaway from these request findings is that brands need to be smart with their prompts, get the timing right, and avoid bombarding their customers at all costs. Remember, this is still a part of the transaction or experience, so annoying customers with endless review request emails could achieve an undesirable result.

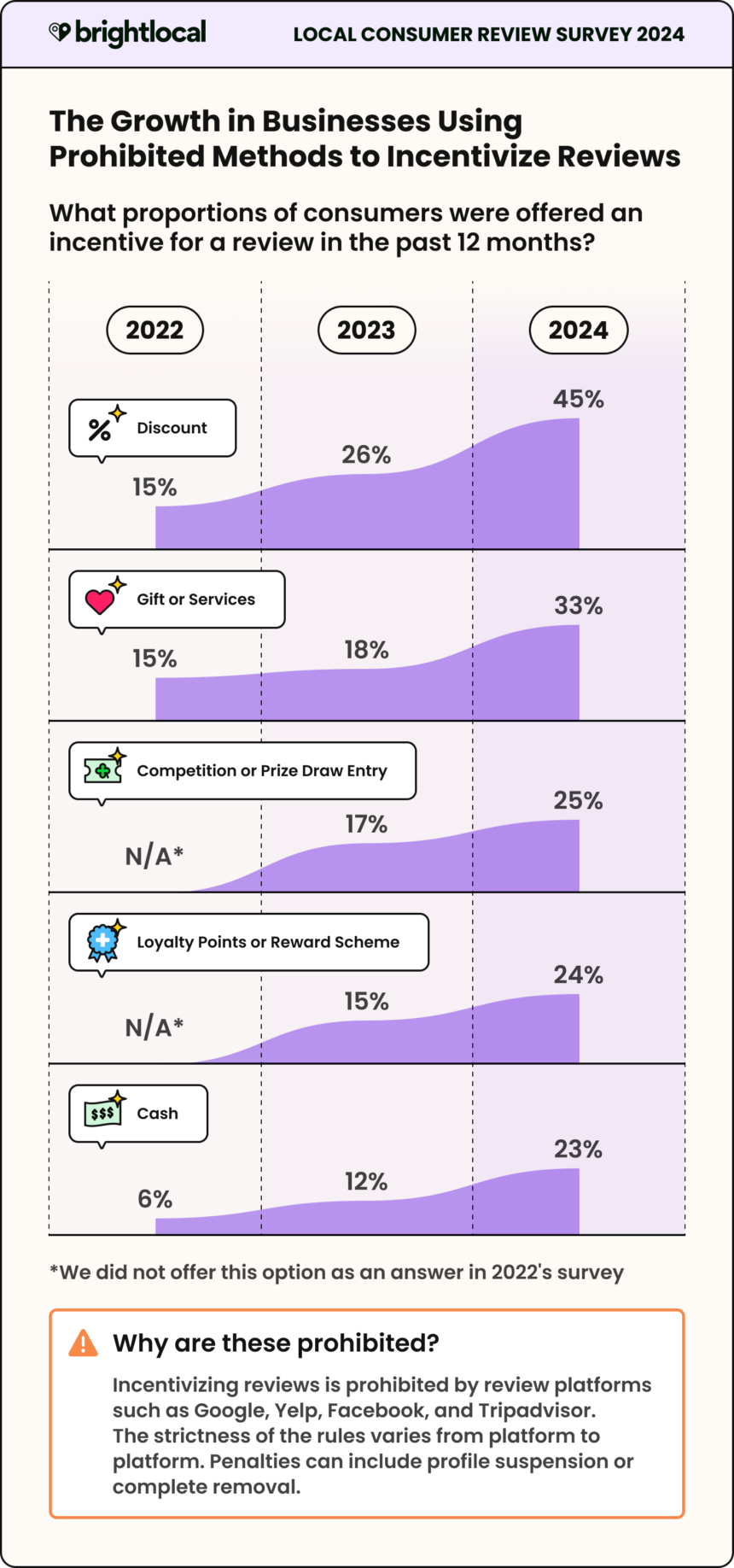

Incentivizing Customers to Write Reviews

Now, while we’ve included incentives within the following section of the report, it is crucial to note that BrightLocal does not endorse the incentivization of reviews in any way.

We can appreciate that there is a lot of conflicting information out there and it’s easy to go down this route to attract more customers to write business reviews. What’s the harm of rewarding loyalty with a simple discount, right? Wrong, unfortunately.

For brands and businesses that aren’t in the know—of which there are many, so if this is you, don’t panic!—it’s important to note that most review platforms prohibit review incentivization. The penalties for incentivizing or buying reviews can vary, including the disabling or removal of your review profiles, or having your profile labeled as one that has unlawfully incentivized reviews.

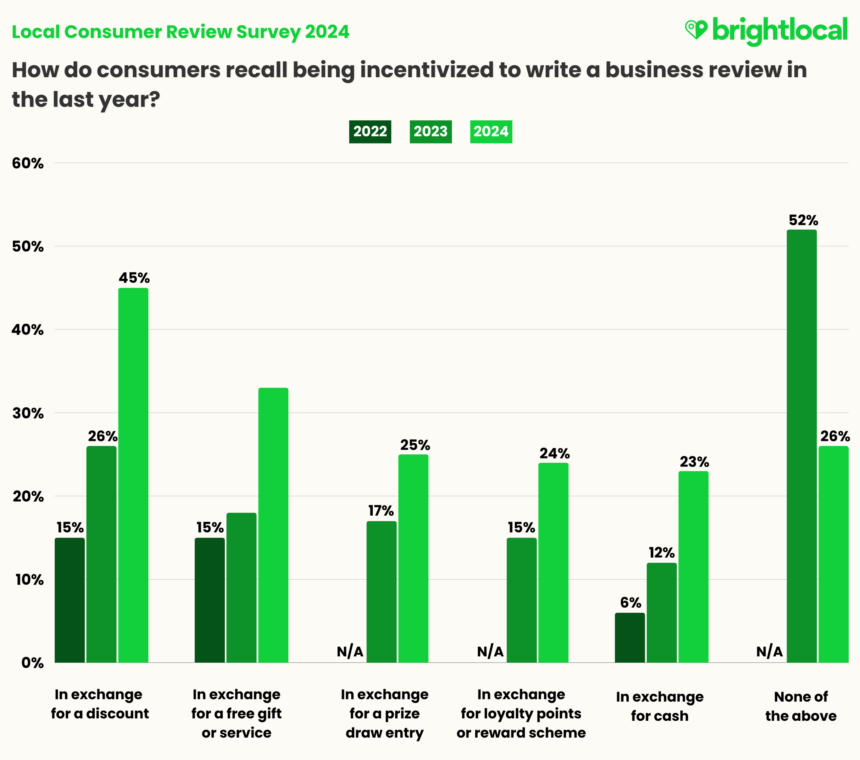

Last year, we found that review incentivization is still sadly alive and well. Given the ongoing issues around the prevalence of fake reviews, we wanted to see if businesses were still going down the incentivization route in 2024. The results are… quite something.

Not only is the practice of review incentivization up across the board but the percentage increases in consumers recalling being offered these incentives is significant.

Increases in Review Incentivization: 2023 vs. 2024

| Discount | |||

| Gift or service | |||

| Cash | |||

| Loyalty points or reward scheme | |||

| Competition or prize draw entry |

It could be that such drastic increases in discounts or free gifts come from a lack of understanding of incentivization rules. As discussed, many businesses don’t know that these methods are prohibited on many platforms, and may have viewed discounts or free gifts as ‘harmless’ ways to reward loyalty.

The fact is that incentivization encourages consumers to leave reviews that they might not have organically, and influences the content of the review—typically in the brands’ favor. Even if they are from verified customers, the reviews cannot be deemed authentic and trustworthy, therefore discrediting the entire system.

Summary

While much of what was important to consumers in 2022 and 2023 holds today, some themes stand out in 2024.

Firstly, it’s more apparent than ever that consumers are checking multiple sources for business reviews and recommendations, including those outside of traditional review platforms. It’s a pressing reminder that reputation management should be viewed as a strategy instead of a task; not something that can be picked up when there’s time. Reputation encompasses both digital and offline channels. Realistically, it should be a shared responsibility and actively factored into areas like social media and community management, email marketing, content strategy, and more.

Next, brand marketers have to be more strategic with their review requests. Automation is a wonderful thing that can speed up tasks for us marketers. But without the human considerations of timeliness and providing customers with the choice of where and how they review, it remains ineffective—or worse, frustrating for consumers.

Several findings hint at a sense of consumer apathy towards the expectation for them to provide reviews after almost every experience with a business. Brands must remain conscious and respectful of this when asking for customer favors. It’s a tricky balance, knowing that review recency is a particularly important review factor.

Ultimately, with all things customer experience, the utmost focus should always come down to exactly that: delivering exceptional, memorable experiences. Give consumers a reason to want to write your brand a review actively; make sure they have things to talk about that others will find useful; be present across your reputation platforms (that includes the alternative channels, like social media), and always keep in mind how local brand experiences contribute to overall brand perception.

Methodology

The Local Consumer Review Survey 2024 was conducted using a representative panel of 1,141 US consumers via SurveyMonkey.

Publications and individuals are welcome to use the research findings, charts, and data, provided that BrightLocal is cited as the author and the page URL (https://brightlocal.com/research/local-consumer-review-survey) is linked to.